The Ultimate Forward Rate (UFR) is an essential element in the construction of the risk-free yield curve provided by EIOPA. The extrapolation of the yield curve converges towards this rate beyond the Last Liquid Point (LLP).

Ultimate Forward Rate (UFR) Calculation methodology

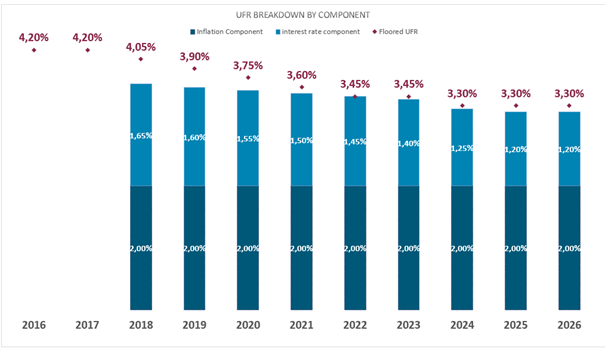

Initially set at 4.2% in 2011 for QIS5 purposes, UFR’s value didn’t change when Solvency II entered into force on January 1st, 2016. In 2017. EIOPA introduced a calculation methodology to determine the UFR on an annual basis. Since then, it has published at springtime the applicable UFR for the following year.

The UFR is determined for each currency as the sum of two components:

- An interest-rate component, corresponding to the average real rates observed since 1961 on a panel of reference markets (Germany, France, Belgium, Italy, the United States, the United Kingdom and the Netherlands). Each year, the panel’s average real rate is included in the historical data (1.49% in 2024).

- A target inflation component, usually equal to the inflation target defined by the reference central bank. For Euro, the ECB set it at 2%.

The UFRn is obtained comparing the value (Sn), sum of these two components, with the UFRn-1 +/- 0,15 %. More concretely:

- UFRn = UFRn-1 – 0,15% if Sn < UFRn-1 – 0,15% ;

- UFRn = UFRn-1 + 0,15% if Sn > UFRn-1 + 0,15% ;

- UFRn = UFRn-1 otherwise.

Thus, the UFR:

- remains unchanged if the expected variation is less than +/- 15 bps ;

- varies by +/- 15 bps otherwise.

Value of the Ultimate Forward Rate in 2026 for the euro currency

For 2026, EIOPA has published a UFR applicable to the euro currency unchanged since 2024:

UFR 2026 = 3,30%

Historical values of the UFR for the euro currency

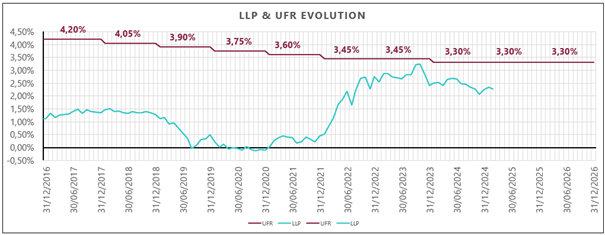

UFR and LLP evolution since 2016

The graph below shows the historical values of the UFR and the interest rates at the LLP.

You can find the full EIOPA publication here.

FR and LLP evolution: analysis 2026

Whereas the rate at LLP maturity is a market rate, and therefore subject to market volatility, the UFR has been designed to provide long-term stability within the Solvency II framework. The sharp rise in interest rates between 2022 and 2023 brought the LLP rate very close to the UFR, resulting in a relatively flat extrapolated part of the yield curve. Since the end of 2023, the LLP rate has moved further away from the UFR, hovering around 2.5%.

FR and LLP evolution: analysis 2025

Whereas the rate at maturity of the LLP is a market rate and therefore subject to market volatility, the UFR was designed to provide long-term stability in the Solvency II framework. The recent sharp rise in interest rates has brought the LLP rate very close to the UFR, resulting in a relatively flat extrapolated part of the yield curve.

FR and LLP evolution: analysis 2024

The graph above illustrates the history of the values of UFR and LLP. The analysis of this history reveals the following:

- LLP went through three main phases:

- 2016-2018: stable around 1.5%;

- 2019-2021: stable around 0%;

- 2021-2023: upward phase with a steep slope.

- Since 2021, LLP has been converging towards UFR due to the significant rise in interest rates observed in the markets.

The main consequence of this convergence will be to influence the steepening of the yield curve, with multiple impacts on the scenarios generated by ESGs, including a distortion of the rate spread.

Furthermore, the UFR for the Eurozone is relatively stable due to the following factors:

- Its inflation component remains constant, with a target inflation rate of 2% set by the European Central Bank (ECB).

- Its interest rate component experiences minimal year-to-year changes. This can be attributed to the extensive historical data spanning over 60 years used to calculate the average.

- The implementation of a corridor helps limit potential significant volatility in the interest rate component.

In contrast, the LLP is much more volatile -as shown in the graph- and is currently experiencing a strong upward trend. If the two curves were to intersect (yield curve inversion), the implications in terms of capital reserves will be significant.

Optimize your capital requirements under Solvency II

With the addactis® Capital Modeling solution, calculate and optimize your capital requirements (SCR, MCR, RBC) under the Solvency II standard formula. Monitor solvency ratios, assess balance sheets, and respond accurately to market shocks. Discover how Addactis can strengthen your Solvency II and Capital Modeling framework.

This content is written by

François BAYÉ

Director – Head of Actuarial Consulting

In-Depth Insights on Solvency II

Explore our complimentary blog articles for related content on Solvency II:

Risk-free rate curves and EIOPA data

Each month, Addactis lists and summarizes the economic parameters used to produce the solvency ratio and the economic balance sheet: risk-free rate curves, volatility correction, symmetrical equity adjustment, etc.

Read our article >

ORSA & Solvency II: turning compliance into strategic advantage

ORSA under Solvency II goes beyond compliance. It serves as a key driver of better governance, strategic planning and risk management.

Read the article >

2020 review of the Solvency II Directive

Addactis experts offer you an analysis of the Pillar 1 major changes, definitely adopted at Level 1 and still draft at Level 2.

Read our article >