Optimize your IFRS 17 compliance with Addactis solution

IFRS 17 compliance, cash-flows generation, CSM calculations, accounting & disclosure requirements… Find out how our solution can smooth your path to IFRS 17 compliance.

Streamline your IFRS 17 compliance process

Facing the complexity and high cost of IFRS 17 compliance?

Addactis offers a powerful and flexible IFRS 17 SaaS solution designed to streamline your compliance process. The Addactis Platform allows insurers to address IFRS 17 reporting requirements through a complete end-to end solution or accounting dedicated module. With advanced technology and actuarial expertise built-in, our IFRS 17 compliance software ensures full traceability, accurate profitability tracking, and seamless management of insurance contracts.

IFRS 17 ACTUARIAL CALCULATIONS SOFTWARE FOR CASH FLOWS & RISK ADJUSTMENT

Managing complex actuarial calculations under IFRS 17 requires a reliable, fast, and fully integrated solution.

Our IFRS 17 solution empowers insurers to handle granular data, apply measurement models, and automate cash flows and risk adjustment projections with full traceability. Our software supports all required IFRS 17 measurement models – BBA, PAA, and VFA – ensuring consistency across your Property & Casualty and Life & Health line of business.

From data preparation to cash flow generation and risk adjustment calculations, everything is centralized in a unique platform. Thanks to its transparent integration capabilities, the Addactis’ solution processes data from multiple systems and enables seamless segmentation and transformation – delivering speed, accuracy, and compliance throughout your actuarial workflow.

IFRS 17 ACCOUNTING DISCLOSURE: CSM, FINANCIAL STATEMENTS & REPORTS

Meeting IFRS 17 accounting and disclosure requirements can be overwhelming without the right tools. The IFRS 17 software simplifies the calculation of the Contractual Service Margin (CSM) at the group-of-contracts level, and automates the production of financial statements and regulatory disclosures.

Our solution provides financial disclosures for both general ledger and subledger, enabling full traceability and auditability of your data. Thanks to its built-in automation and Microsoft® Excel add-in, users can customize financial reports, automate updates, and streamline their entire IFRS 17 disclosure process with ease.

Designed to support both accounting and actuarial teams, our IFRS 17 business app helps you stay compliant while gaining valuable insight into your financial performance under IFRS 17.

FEATURES

Master your IFRS 17 compliance through a single software

Our flexible and integrated actuarial and financial solution adapts to any organization (International or local), line of business (P&C or Life & Health), and to any level of preparation in the IFRS 17 compliance project.

Compliance

One system to address all IFRS 17 standard requirements.

Flexibility

Adjust for elements that are specific to your business or accounting scheme.

Actuarial monitoring

Incorporate the new financial reporting requirements in the internal steering as well as the investor story.

Fast & efficient process

Time from closing to reporting remains a critical indicator.

Audit trail & tracking of results

Security of the IFRS 17 process and speed of the analysis.

Current regulatory updates

Continuous regulatory watch and software’s adaptation.

THEY TRUST US

More than 50 insurance companies use our solution

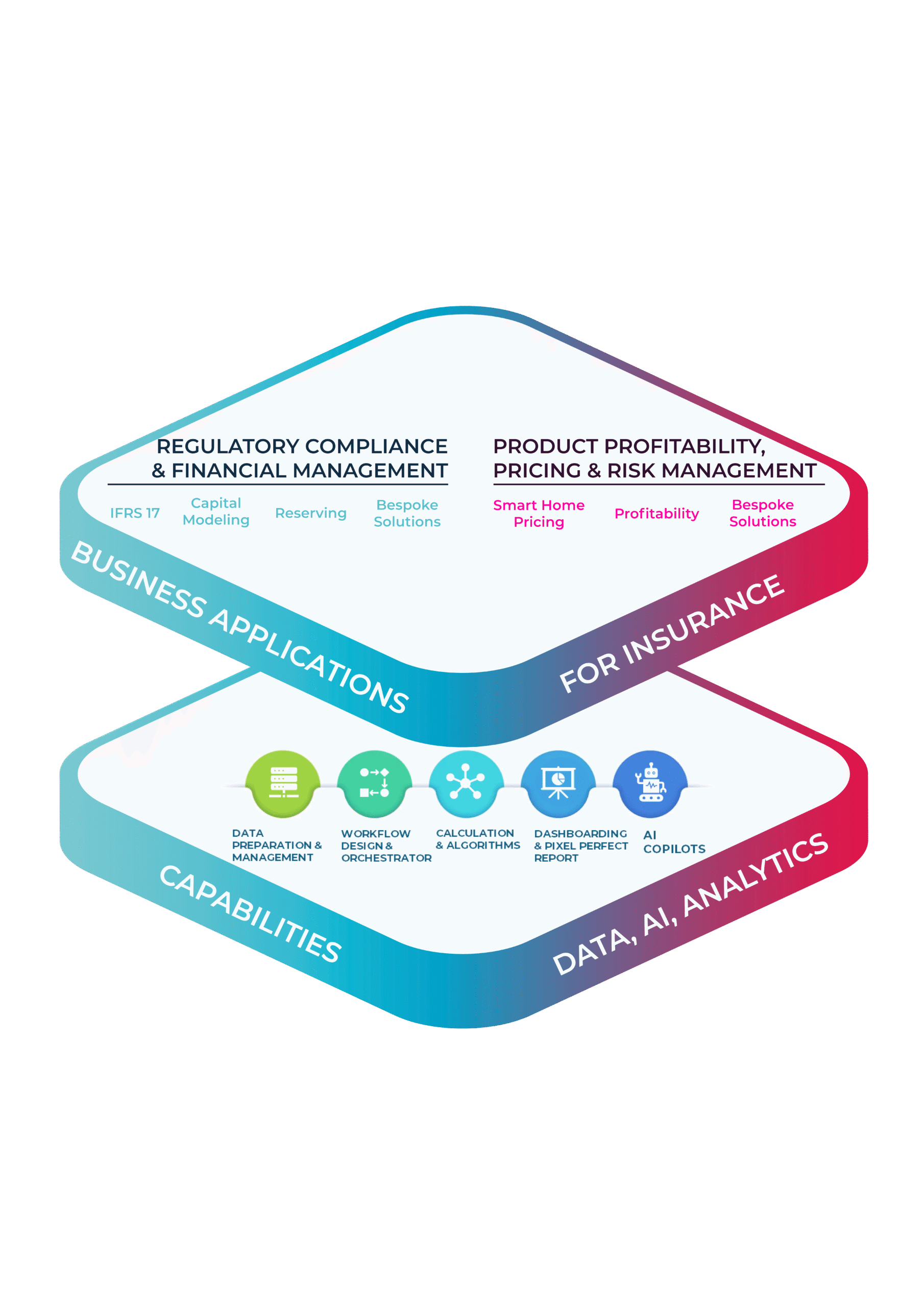

THE ADDACTIS PLATFORM

Our solution is part of the next-generation Actuarial Risk Management Platform

Our comprehensive SaaS platform is designed to transform and accelerate the development and customization of insurance solutions. Whether you specialize in Life insurance or non-life insurance, our platform promises to deliver substantial business value and operational efficiency.

Experience unparalleled reliability, efficiency, and innovation with a system crafted to meet the dynamic needs of the insurance industry. Elevate your business operations today and stay ahead of the competition with our unique, cutting-edge solution.

Our platform is the only one on the market that seamlessly addresses both regulatory and profitability scopes, ensuring your success in a highly competitive landscape.

A unique and unified actuarial platform, designed to ensure compliance and profitability, through a range of powerful solutions.

Thanks to the Addactis Platform, the IFRS 17 solution is connected to other business applications.

RESOURCES

Explore our content related to IFRS 17

Find out more about our IFRS 17 expertise by reading the analyses and insights regularly published by our experts.

10 tips to make your IFRS 17 project a success

IFRS 17 is a major transformation for insurance companies. It impacts accounting, actuarial processes, IT systems, and financial governance. Its implementation can be a challenge, but with the right approach, it becomes an opportunity for structuring and optimizing your processes.

Mutualidad renews its trust in Addactis through its IFRS 17 project

Mutualidad renews its trust in Addactis through its IFRS 17 project. Read more about this insurance company’s experience.

Data, systems integration, processes, reporting…The strategic role of Finance in IFRS 17

In the rapidly evolving insurance industry, finance and accounting teams are essential drivers of operational improvement and regulatory compliance. Discover our article about the Strategic Role of Finance in IFRS 17.

FAQ

More about IFRS 17

How to implement IFRS 17?

To implement IFRS 17, insurers must prepare quality data, choose the right software, define calculation models (BBA, PAA, VFA), and integrate systems for accounting and reporting. Testing and training are key before going live. Our IFRS 17 solution simplifies this process with prebuilt modules, automation, and expert support for faster, compliant deployment.

Does the solution support all IFRS 17 measurement models?

Yes, our solution supports all three IFRS 17 measurement models: the Building Block Approach (BBA), the Premium Allocation Approach (PAA), and the Variable Fee Approach (VFA). This ensures full compliance across all insurance product lines.

What are the benefits of all-in-one IFRS 17 software?

An end-to-end IFRS 17 software like Addactis centralizes all data, automates workflows, reduces manual errors, and enables quick and reliable reporting to meet regulatory deadlines and audit requirements.

Solutions

Premium contents

Careers

Governance

ESG

Personal data protection Charter

Partner Program

Contacts

addactis® is a registered trademark, property of ADDACTIS Group SA, used by our companies to market their service offering.

©2026 - ADDACTIS Group - all rights reserved