Regulatory standards require insurers to evaluate the economic value of their balance sheet in a market consistent way. To that end, insurers use Economic Scenario Generators (ESG) to assess different economic risk factors and project financial returns cashflows.

ESG in multi regulatory standards framework

Recent ESGs represent each risk factor using increasingly complex financial models which induce costly challenges in the production process. This complexity is amplified in a multi-norm framework where insurers are compelled to generate intensely multiple economic scenarios tables using different assumptions.

This article defines an integrated production process to accelerate ESG tables production in a multi standard framework.

It identifies conceivable acceleration methodologies according to the sensitivities to be produced. It finally discusses the operational implementation of the acceleration process.

Standard ESG Production process

Under Solvency II or IFRS 17 regulatory standards, insurers apply market-consistent approaches to evaluate their balance sheets. The use of ESGs and Monte-Carlo methods is thus necessary to evaluate the cost of financial options and guarantees embedded in life insurance policies.

Several economic risk factors can be modelled in an ESG: rates, equities, real estate, inflation and credit spreads, using stochastic financial models and following a specific production process: calibration, diffusion and validation.

The first step requires market consistent fitting of stochastic model’s parameters to spot market data when listed or to historical market data (e.g. calibration of real estate models).

With the use of correlation matrix, calibrated parameters are then injected in stochastic differential equations to project multiple scenarios of financial returns.

Finally, generated scenarios undergo many statistical and Monte-Carlo tests to insure their martingality and market consistency.

ESG Complexity

Increasingly complex financial models are used in recent ESGs to satisfy regulatory requirements and generate scenarios consistent with the changing market context. These models engender many challenges to insurers at each step of the production process, and especially at calibration.

In fact, calibration of highly parametrized models is complex as the optimization algorithms estimate at each iteration theoretical semi-closed formulas.

The optimization problem becomes extremely complicated, and its convergence is time consuming. Furthermore, calibrated parameters are often saturated, i.e. occurrence of inaccurate calibrations where parameters are trapped in interval bounds defined in the optimization algorithm, leading to market consistency problems.

ESG operational challenges in multi-standard context

Along with the technical challenges of the complex models used in the ESG, the intensity of production increases drastically in a multi-standard framework, where insurers generate several economic scenarios tables for their quarterly or annual statements production or for their own studies.

These sensitivities include either a movement of the yield curve or the volatility levels, for instance:

- Solvency II closings: ESG tables using rate curves with and without volatility adjustment (VA) and applying standard formula chocs.

- IFRS 17 closing: ESG tables using rate curves with different VA levels according to the portfolio and for AoC.

- ESG tables for ORSA sensitivities.

- MCEV calculations: ESG tables with different interest rates and volatility chocs.

The standard production process becomes operationally intensive and can be accelerated by directly adjusting the economic scenario tables from a central reference table parameters or scenarios.

Furthermore, ESG calibrated parameters and scenarios produced for annual statements could be adjusted to accelerate quarterly closings.

ESG: Acceleration Production Process

Many acceleration methodologies are conceivable accordingly to the sensitivities to produce:

- Forward adjustments of a reference table, used for nominal rates yield movements.

- Adjustment of a reference table parameters without recalibration, used for sensitivities impacting volatility assumptions.

- Adjustment of equity trajectories without recalibration or regeneration, used for sensitivities affecting equity volatility assumptions.

- Pre-processing of calibration on a very large number of initial conditions and construction of a calibration reference frame to select the “nearest neighbour” parameters or to calibrate a proxy base on Machine Learning

Forward rate adjustments method

This methodology consists of adjusting a reference table following a change in the level of initial rates while implied volatilities levels remain the same. It could be used to produce tables for solvency 2 closings (interest rate shocks and with/without VA sensitivities), IFRS 17 VA sensitivities, ORSA sensitivities.

The approach applies forward zero-coupon prices ratios to the reference table and produce new economic scenarios without recalibration or regeneration.

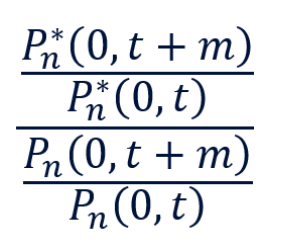

The forward zero-coupon price ratio includes ante/poste evolution of the yield curve:

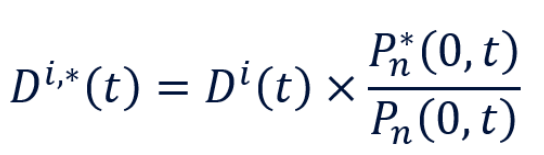

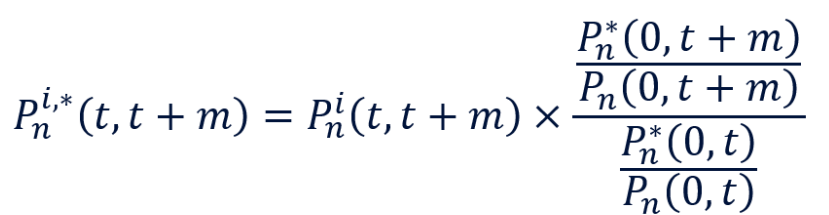

For instance, adjusted deflator or ZC nominal prices scenarios are expressed below:

Deflator:

Nominal ZC price:

Formulas following the same principle can be applied to the other risk variables: equity, real-estate, inflation, real ZC price and risked rates.

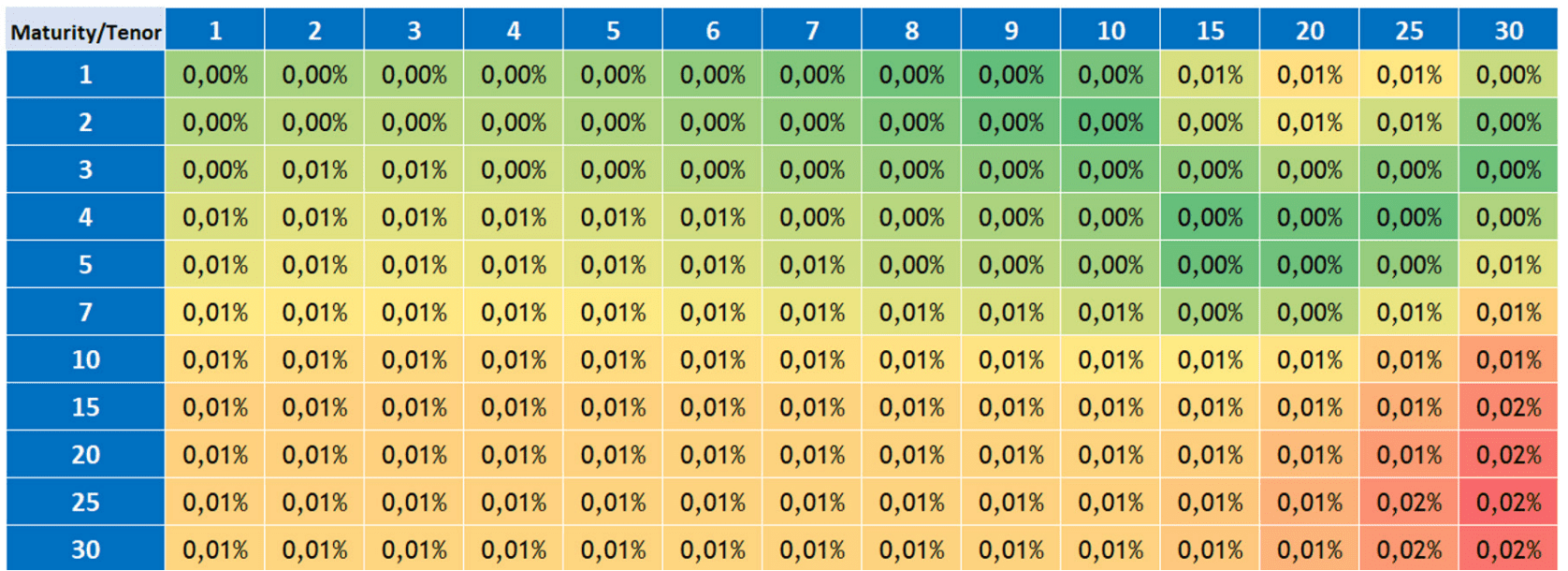

Figure 3 – absolute differences between implied Monte-Carlo normal swaption volatilities ante/post +200 Bps evolution of the yield curve

The adjusted scenarios remain perfectly martingale by construction in this approach and their market consistency is not altered. In practice, ante/post implied Monte-Carlo normal swaptions volatilities vary slightly even for a considerable movement of rate levels as shown in the matrix above.

Model parameters adjustment method

This approach consists of adjusting directly ESG model parameters following to a change in volatility level assumptions. It is suitable for sensitivities with volatility shocks or for market data changes between two closings. However, scenario tables need to be regenerated with the new adjusted parameters.

Discover the complete approach by downloading our full expert’s paper.

Conclusion

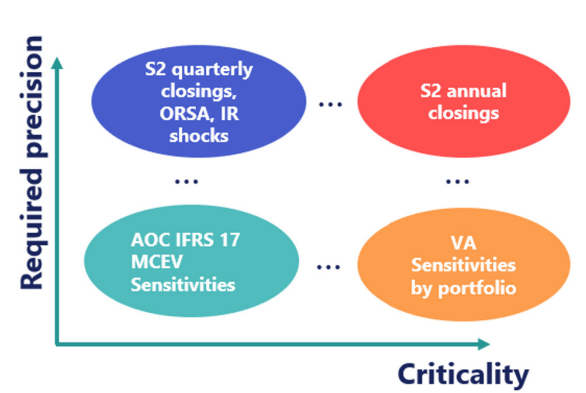

ESG production in a multi-standard framework becomes operationally intense. Approaches to accelerating ESG production with varying effectiveness have been presented in this article. The industrialisation of ESG production acceleration demand then the construction of a decision tree allowing the operationalisation and governance of the system.

For example, Solvency II annual closings can be qualified as highly critical and require a high level of precision. Hence, by producing a central economic scenario table without VA, it is possible to use the forward adjustment method to speed up the production of

the remaining sensitivities. yet, the parameter adjustment method would be unsuitable.

On the other hand, quarterly solvency 2 closings can be qualified as less critical but still require a high level of precision. In this case, the acceleration of ESG production by the forward adjustment method can be complemented by the use of the parameter

adjustment method based on precisely calibrated annual parameters.

Consequently, the industrialisation of the methods presented above in this chapter for accelerating the production of ESG requires :

- Qualifying each sensitivity in terms of criticality, i.e. the degree of precision required

according to the issue at stake in the calculation. - Having pre-assessed the effectiveness of each method in the context of standalone

and joint sensitivities.

Read the complete analysis

Want to go further? Read the complete analysis of our experts by clicking on the button below.

Approaches to accelerating ESG production with varying effectiveness have been presented in this experts’ paper : The industrialisation of ESG production acceleration demand, then the construction of a decision tree allowing the operationalisation and governance of the system.

Facilitate your Solvency II compliance with Addactis

addactis® Capital Modeling software supports Solvency II compliance in line with the Solvency II directive and other regulatory standards, covering key actuarial requirements. Our Solvency II software helps insurers streamline governance and risk management while remaining agile and compliant in complex regulatory environments.

Related content on Solvency II

Risk-free rate curves and EIOPA data

Each month, Addactis lists and summarizes the economic parameters used to produce the solvency ratio and the economic balance sheet: risk-free rate curves, volatility correction, symmetrical equity adjustment, etc. Read our article now.

Data and process automation in actuarial, risk, finance functions

Data & process automation in insurance for actuarial, risk, finance functions: impacts, benefits, challenges, success factors, etc. Discover why transform your processes

Transforming Financial Reporting in Insurance: From closing cycles to continuous insight

Transforming Financial Reporting in Insurance: From closing cycles to continuous insight. Discover some tips from our experts.