The insurance industry is entering a new era.

Faced with growing demands from policyholders, increasing complexity of risks, and pressure on margins, market players must reinvent their models. In this context, artificial intelligence (AI) is emerging as a key driver of innovation and performance, by making complex actuarial results and business decisions more transparent, understandable, and actionable.

At Addactis, we firmly believe that artificial intelligence and machine learning are transforming the Insurance industry for the better, especially when it comes to risk management. We are supporting this transformation by putting the power of AI at the service of insurers and actuaries.

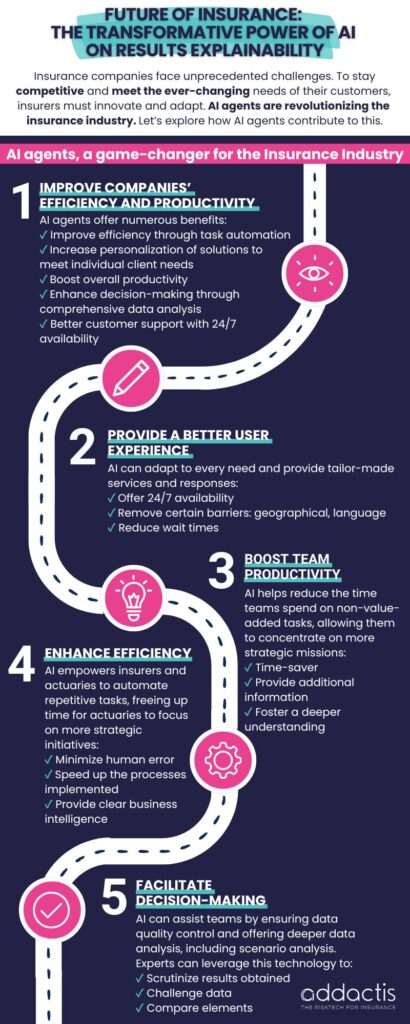

AI Agents, a game-changer for the insurance industry

In this article, we explore how AI agents contribute to the explainability of results by providing detailed information on complex processes and ensuring that decisions are transparent and understandable.

Discover the key points of the power of AI on results’ explainability for insurers, actuaries, CFO and CRO in our infographic:

- Enhanced explainability of complex actuarial results

- Increased productivity through automation of low-value tasks, freeing up time for higher-value tasks

- Improved customer experience with 24/7 intelligent support and multilingual capabilities

- Greater operational efficiency via reliable, intelligent and traceable calculations

- Faster and smarter decision-making powered by advanced data analysis

Each of these benefits plays a strategic role in transforming insurance operations. Discover the full picture in our infographic below.

An enriched customer experience, thanks to AI

Today, policyholders expect quick, accurate, and accessible answers at all times. AI-powered intelligent agents meet these expectations by:

- ensuring 24/7 availability,

- removing language and geographical barriers,

- and offering personalized services.

We integrate these technologies into our solutions to enable our customers to offer a seamless and modern experience.

Towards an increased team productivity

AI reduces the time spent on low-value-added tasks, such as:

- data entry,

- report generation,

- manual calculation verification.

This allows teams to refocus on tasks with high strategic value, such as analysis, forecasting and consulting.

Addactis’ Vision

It is with this in mind that Addactis designs its tools: to augment human expertise, not replace it.

Operational efficiency as a driver of performance

Intelligent automation helps speed up processes, minimize errors, and make calculations more reliable.

Addactis’ Vision

Our solutions are based on AI engines capable of processing large volumes of data while ensuring the traceability and explainability of results – a crucial point in the insurance and actuarial professions.

Making informed decisions

AI is not limited to execution, it is also becoming a decision-making tool.

Thanks to advanced data analysis, it provides a better understanding of possible scenarios, questions the relevance of the results obtained, and compares different options.

This reinforcement of decision-making intelligence contributes to better risk management and more informed trade-offs.

Addactis, your partner in intelligent transformation

We firmly believe that AI is a lever for the future of insurance.

That’s why Addactis develops intelligent, ethical and, above all, explainable solutions designed for the concrete challenges faced by insurers and actuaries.

Our AI agents, integrated into the Addactis Platform, act as true expert assistants.

They answer business questions (IFRS 17, capital modeling, reserving), explain numerical results with clear narratives, and rely on regulatory sources to ensure the reliability of their answers. Far from being “black boxes,” they make calculations transparent and justifiable, down to the finest detail.

For example, our explainability agent can:

- Analyze a complex figure,

- Trace its origin in the calculation engine,

- Cross-reference the results with official documentation,

- Generate an understandable explanation—where a standard report would not suffice.

It is this ability to combine performance, understanding, and traceability that makes Addactis’ AI a real lever of trust and transformation for our customers.

Discover the Addactis Platform

An integrated SaaS platform for regulatory compliance and profitability

Tailored to the insurance market, our solution offers a unified platform for multiple use-cases, ensuring data freshness for timely decision-making, providing significant business value and operational efficiency, enhancing team collaboration, ensuring regulatory compliance and optimizing risk management.

Related articles: new technologies, AI and innovation in Insurance

How new technologies are shaping the insurance risk management?

New technologies, particularly AI and machine learning, are revolutionizing risk management. They allow us to analyze vast amounts of data quickly and accurately, leading to more precise risk assessments and better pricing strategies.

![[Addactis Platform] Bannière LKD - Profil Addactis [Addactis Platform] Bannière LKD - Profil Addactis](https://www.addactis.com/wp-content/uploads/2025/03/Addactis-Platform-Banniere-LKD-Profil-Addactis.png)