ORSA, a central tool under Pillar II

Solvency II is the prudential framework for insurance and reinsurance companies in the European Union. Its main goal is to create a common understanding of risks among all stakeholders and to consider the wider impact on financial stability. Insurance companies need to carry out a forward-looking assessment of their risk and solvency situation, known as the Own Risk and Solvency Assessment (ORSA).

“The ORSA is the entirety of the processes and procedures used to identify, assess, monitor, manage, and report the short- and long-term risks an insurance company faces or may face and to determine the own funds necessary to ensure that the company’s overall solvency needs are met at all times.”

In practice, ORSA covers all the processes insurers use to identify, evaluate, monitor, and manage risks during the planning period, as well as reporting and determining capital adequacy.

ORSA links governance, risk management, and decision-making, helping insurers stay resilient under changing conditions. Regulators expect insurers to use ORSA not just for compliance, but to better understand their business, plan ahead, and maintain confidence in their solvency and operations.

How the Solvency II framework is structured

The Solvency II regulatory framework is structured into three pillars:

- Pillar I sets the quantitative requirements such as the assets and liabilities valuation and capital requirements to ensure that insurers hold sufficient capital to meet their obligations.

- Pillar II sets the qualitative requirements, including governance and risk management of the undertakings and the Own Risk and solvency Assessment (ORSA) to evaluate their risk profile and ensure adequate capital.

- Pillar III sets the supervisory reporting and public disclosure, aiming to enhance market discipline with transparency.

If we focus on Pillar II, it emphasizes the importance of strong governance and effective risk management systems. It requires insurers to conduct regular risk assessments and ensure that the management are actively involved in overseeing these processes.

The ORSA serves as a critical tool for insurers to assess their risk exposure and determine the necessary capital to cover those risks. It informs both internal decision-making and regulatory reporting, ensuring that they stay solvent under various scenarios. Supervisors expect insurers to integrate ORSA outcomes into strategic planning and decision-making processes.

Key Challenges for insurers in Solvency II implementation

Insurance companies face several key challenges when implementing Solvency II. Insurers need to invest in data quality, advanced modeling, documentation, and cross-functional collaboration to while managing risks effectively.

Data collection and data quality

Under Solvency II, insurers must ensure a high level of data quality to ensure the reliability of capital calculations and regulatory reporting.

To achieve this, they must implement robust processes for data collection, management and validation, maintain relevant documentation and provide data traceability to show compliance to regulators. They need also to continuously monitor and improve data quality and select the right performance indicators.

A strong and effective data quality offers better decision making, operational efficiency and strengthen overall company performance while meeting regulatory requirements.

Scenario analysis and stress testing

Scenario analysis and stress testing are essential for evaluating how a company might respond to extreme events. They are challenging for insurers because they require accurate, high-quality data and advanced modeling capabilities to simulate potential outcomes.

Designing realistic scenarios is complex as insurers must consider a wide range of risks and integrating the results into strategic decision-making adds another layer of difficulty. The challenge lies not only in running these tests but ensuring that the insights inform strategy and capital planning. These exercises require historical data, robust models, and integration with business decision-making.

Documentation and audit trail

Regulators want to see that insurers can trace every step of their risk assessment and reporting. This means documenting how data was collected, processed, and used in ORSA calculations.

Strong systems and trained staff are essential to ensure everything is auditable and compliant.

Ensuring alignment across risk management, actuarial, and financial functions

Risk management, actuarial, and finance teams often use different data sources and models which can lead to discrepancies in risk assessment and capital calculations. However, under ORSA, insurers must maintain consistency across functions.

Ensuring alignment requires strong governance, clear communication and standardized processes across teams. Without this consistency, decision-making can be fragmented, reporting may be unreliable, and regulatory compliance compromised.

How Technology strengthens ORSA Compliance

Under Solvency II context, ORSA demands forward-looking, holistic assessment of risks, capital and strategy. Risk models require multiple data feeds and scenario analyses. Manual aggregation and spreadsheet-based workflows lead to delays, errors, limited traceability and lack of scalability.

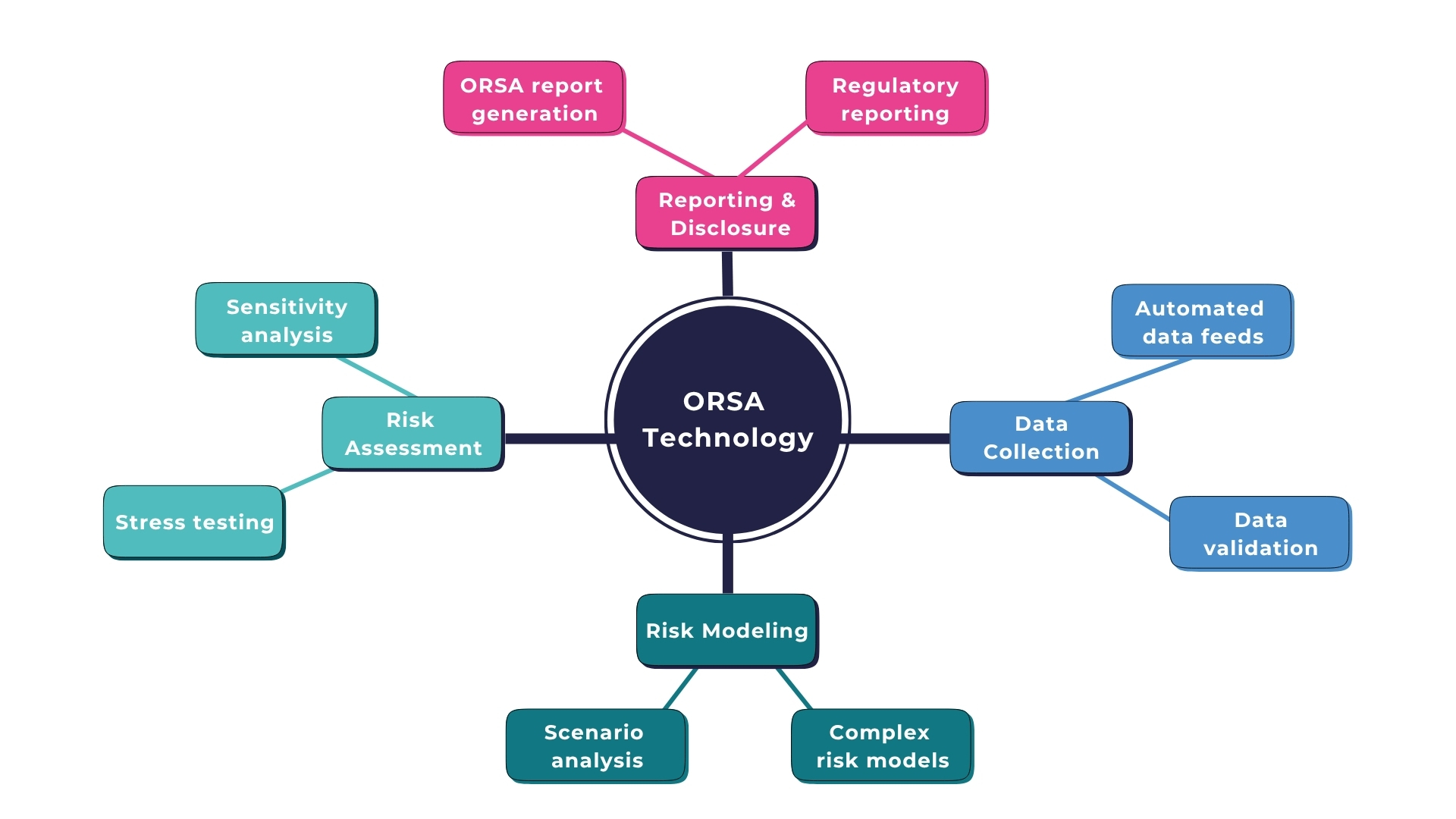

The above map illustrates the role of technology in ORSA processes.

Here, technology comes into play and brings a key role in ORSA, helping with data collection, risk assessment, risk modeling and of course reporting and disclosure. All the different processes such as data feeds, data validation, scenario analysis, risk modeling, sensitivity analysis and stress testing can be automated and improved with the right tools.

Automated systems reduce human error, accelerate timelines, support real-time analysis and help insurers respond to emerging risks more efficiently. Automating data-collection, validation, calculations and reporting ensure consistency across the process.

Furthermore, technology enhances traceability, as every input and calculation can be tracked within the system, which is a requirement for ORSA governance.

It also improves scalability, which is needed because insurers’ risk profiles evolve over time, requiring frequent stress-tests, scenario runs and dynamic recalibration. Manual processes cannot sustain multiple iterations at scale.

To have an effective ORSA, insurers must integrate technological solutions that interface seamlessly with actuarial models, risk-data warehouses, finance ledgers and reporting systems. The system must consolidate all relevant data, align risk appetite with capital allocation, and provide comprehensive dashboards for board-level oversight.

In summary, by moving away from manual, fragmented processes and adopting integrated, automated, scalable technology platforms, insurers can transform ORSA from a compliance exercise into a dynamic risk-capital management tool.

ORSA driving value beyond compliance

The ORSA is not just a regulatory requirement. It serves as a key driver of better governance, strategic planning, and risk management across the organisation. Being compliant with regulatory standards is essential, but the real value of ORSA lies in its ability to help anticipate emerging risks and support long-term business resilience.

Technology and software solutions play a pivotal role in this process. Advanced tools improve data quality, automate complex calculations, and facilitate real-time risk monitoring.

They enable insurers to run stress tests, integrate ORSA into strategic decision-making, and demonstrate robust compliance to regulators.

By effectively leveraging these technological solutions, insurers can transform ORSA from a compliance obligation into a dynamic, forward-looking management tool that strengthens both strategy and solvency.

Drive ORSA & ALM under Solvency II with Addactis

Use scenario modelling, stress tests and governance tools embedded in addactis® Solvency II solution to anticipate risks and support informed strategic decision-making. Align your ORSA process and ALM framework with insurer-wide controls and risk appetite to ensure consistency across the organisation.

Related articles on Solvency II and Technology

2020 review of the Solvency II Directive

The Addactis experts offer you an analysis of the Pillar 1 major changes, definitely adopted at Level 1 and still draft at Level 2.

Read More >

2020 review of the Solvency II Directive: Draft amendments to delegated acts

The European Commission then published draft Level 2 amendments (delegated acts) in July 2025, providing technical details to the directive. The Addactis experts detail the major changes relating to Pillar 1.

Download now >

How new technologies are shaping the insurance risk management?

New technologies, particularly AI and machine learning, are revolutionizing risk management. They allow us to analyze vast amounts of data quickly and accurately, leading to more precise risk assessments and better pricing strategies.

Read More >