Reserving: Bornhuetter-Ferguson & Loss Ratio, two reserving methods complementary to the Chain Ladder method

What are the differences between the Chain Ladder method and Bornhuetter-Ferguson or Loss-Ratio methods?

As a regulatory obligation, and in order to cover its future commitments to its policyholders, it is essential for an insurer to have an accurate and correct estimate of its reserves.

As detailed in our previous article, the Chain Ladder method is the most widely used non-life reserving method on the market. However, there are situations in which it cannot be used or is unsuitable. In these cases, two other categories of deterministic methods are very commonly used by non-life insurers:

- Bornhuetter-Ferguson and Loss ratio methods, based on loss ratios (Claims/Premiums: S/P): methods that we will discuss in this article.

- And the Average Cost and Average Cost per Claim methods, based on average costs: methods that we will present to you shortly in a future article.

Below, we present the Bornhuetter-Ferguson and Loss ratio methods, which are very useful, and even essential, as a complement to the Chain Ladder in order to obtain a good estimate of reserves.

Bornhuetter-Ferguson & Loss Ratio reserving methods: Presentation & Applications

What the Bornhuetter-Ferguson and Loss Ratio methods have in common is that they both use an exogenous input: the S/P ratios and information on the ultimate earned premiums expected by the insurer.

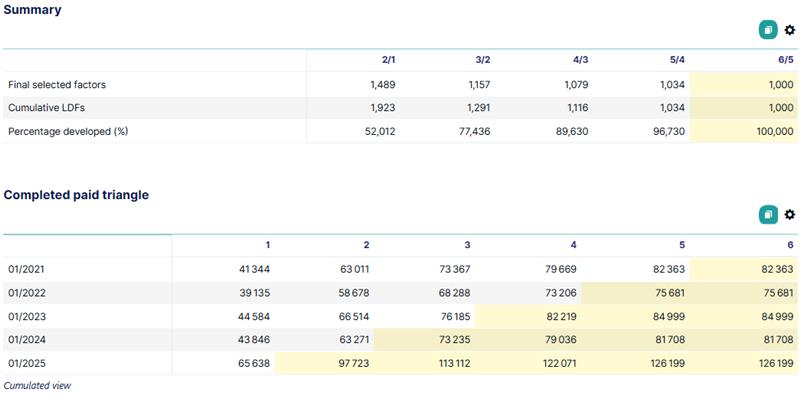

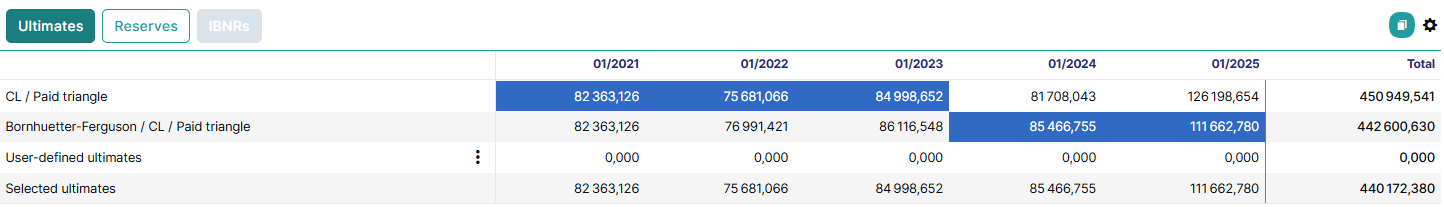

- The Bornhuetter-Ferguson method combines an estimate of the loss ratios with an estimate of the ultimate earned premiums. Multiplying these two elements gives an estimate of the ultimate cost of claims, which will then be redistributed – to complete the claims triangle – using the rate of settlement observed for the risk studied.

- The loss ratio method works in exactly the same way as the Bornhuetter-Ferguson method, but it stops at the estimate of the ultimate cost of claims; no amount is redistributed.

Addactis experts’ opinion

The Loss Ratio method is mainly used where there is no historical data, such as when a new policy is launched. In these situations, the claims history (and therefore the associated claims triangle) is non-existent or insufficient for the Chain Ladder method (or other traditional reserving method) to be applied correctly. The Loss Ratio method is therefore the alternative for estimating reserves.

The Bornhuetter-Ferguson method is frequently used as a complement to the Chain Ladder method. Its advantage is that it is not directly linked to historical data (and therefore to the associated claims triangle), which makes it an excellent alternative for estimating the ultimate for the most recent periods of origin.

Indeed, for the oldest periods of origin, the years being greatly developed, confidence in the application of the Chain Ladder LDFs is relatively high. However, for the most recent periods of origin, and in particular the most recent, an inconsistency in a historical amount will have a very strong impact on the calculated reserve and could lead the insurer into situations that it should avoid. For example, in the case of the last original period which only contains a historical amount:

- if the period is abnormally loss-making (amounts settled are too high), then the projection will lead to over-reserving, which will have an impact on the insurer’s accounts;

- and conversely, if the period is abnormally low in claims (amounts settled too low), then the projection will result in under-reserving, which could lead to a shortfall in funds at the time of future claims settlements.

It is therefore common for non-life insurers to use the Chain Ladder method, except in the most recent original periods when the Bornhuetter-Ferguson method is used.

Bornhuetter-Ferguson & Loss Ratio reserving methods: Advantages & Limitations

Like all reserving methods, the Bornhuetter-Ferguson and Loss Ratio methods have their own advantages and limitations, which should be taken into account when choosing the appropriate method to use.

Advantages and limitations of the Bornhuetter-Ferguson method

Advantages of the Bornhuetter-Ferguson method

- + The method is not linked to the observed claims triangle and is therefore less sensitive to data anomalies.

- + Introduction of parameters outside the triangles

- + Appropriate method for estimating the most recent periods

Limitations of the Bornhuetter-Ferguson method

- – Result highly dependent on the quality of the claims ratios

- – Method nevertheless partially linked to the observed claims triangle via the use of development factors

Advantages & Limitations of the Loss Ratio

Advantages of the Loss Ratio method

- + Easy to implement

- + Relevant for recent or less mature portfolios

Limitations of the Loss Ratio method

- – As with the Bornhuetter-Ferguson method, results depend heavily on the quality of the loss ratios

- – Can be disconnected from observed reality

- – Should be avoided as soon as the insurer has sufficient historical data

Addactis experts’ opinion

As mentioned above, the main concern with these methods is the justification of the parameters. As they are directly based on an exogenous parameter, the claims ratios, the auditors and the regulator can be very demanding about their justification. These ratios must be justified using the insurer’s experience or benchmarks.

But this makes them very good methods for volatile lines of business or those with a low frequency and high severity of claims. These methods are also easily comparable with budget assumptions, and provide a clear indicator that can be communicated to the business lines.

Finally, it should be noted that an extension of the Bornhuetter-Ferguson method, the Cape Cod method, enables claims ratios to be refined, which is a plus.

Further content on the reserving theme:

Streamline your Reserving process with Reserving by Addactis®

We are pleased to introduce Reserving by Addactis®, our new cloud-based SaaS solution designed to simplify and optimize your reserving processes.

Reserving: Chain Ladder, the essential method

In non-life insurance, reserving is a regulatory component of risk management. Its purpose is to estimate the technical provisions needed to cover the insurer’s future commitments.

Benchmark: practices and challenges in non-life reserving methods

In 2024, the addactis observatory conducted a nationwide survey of non-life insurers in the French market, in order to update its previous studies and highlight market trends in a rapidly changing environment.