Introduction to the reserving methods

In non-life insurance, reserving is a regulatory component of risk management. Its purpose is to estimate the technical provisions needed to cover the insurer’s future commitments.

The most important amount to be calculated for a non-life insurer is the reserve, it represents the estimated amount required to settle all claims incurred but not yet reported, and claims reported but not yet settled. This amount is set aside in the insurer’s accounts.

Ensure the insurer’s solvency

Comply with national and international regulatory requirements (Solvency II and IFRS 17)

Efficient claims management – need for an estimate that best approximates future claims experience

To calculate their reserves, insurance companies have several actuarial methods at their disposal.

- Among deterministic methods (based on closed formulas), the most widely used are Chain Ladder, Bornhuetter-Ferguson, Loss ratio, Average cost and Average cost per claim.

- The most widely used stochastic method (based on simulations) is Bootstrap.

In this article, we present the most widely used non-life reserving method on the market: the Chain Ladder method, its advantages and limitations, as well as case studies. Our experts will also share their views on the subject.

Overview & applications of the Chain Ladder reserving method

Chain Ladder is a calculation method used to estimate insurers’ reserves. It is based on historical claims payments, organized in the form of triangles. The aim is then to complete the triangles and deduce future payments by analyzing historical trends in past payments.

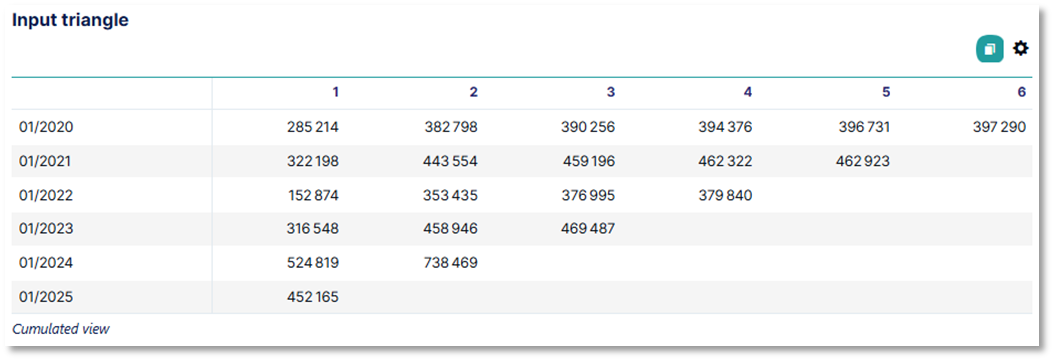

- Drawing up the data triangle

Each payment is associated with two dates:

-

- In line (period of origin): the date on which the claim occurred (more or less precise: year, quarter, month).

In other cases, it may be the date on which the insurance contract relating to the claim was taken out, or the date on which the claim was reported to the insurer.

-

- In column (development period): the actual date of payment (again, more or less precise: year, quarter, month).

- Determine development factors/coefficients

A triangle of ratios must first be calculated to determine, for a given line, the multiplicative factor that allows us to pass from one development period to another.

Then, from this ratio triangle, it is possible to calculate a factor between two development periods using several calculation techniques: average of ratios in the same column, weighted average, etc.

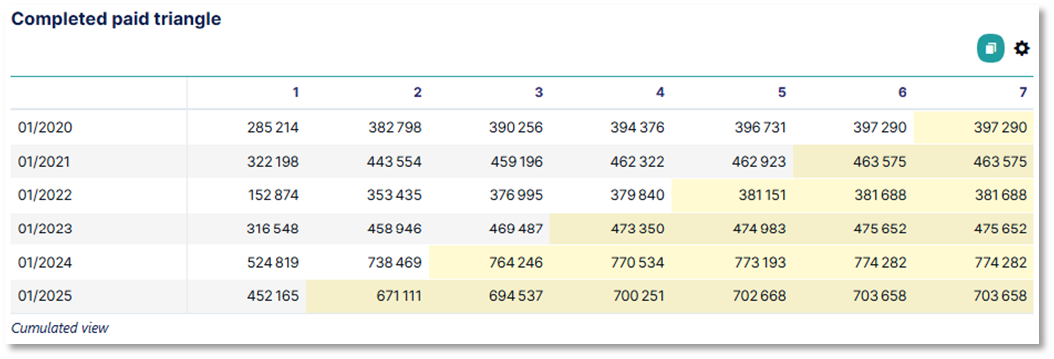

- Projecting future payments

From the development factors previously calculated, it is then possible to project the future data of the triangle, starting by applying these coefficients to the last known amounts, and continuing, column by column, until the triangle has been completed. The reserves can then be deducted by subtracting the last column (the ultimate) from the last known diagonal (the up-to-date data).

Addactis experts’ opinion

The advantage of the Chain Ladder method is that it can be applied to most non-life reserving lines of business! Theoretically, the following assumptions must be validated in order to use the method:

- Stable development ratios;

- Data homogeneity;

- Independent development periods;

- Absence of systematic changes (no changes in claims settlements or market conditions that could drastically affect ratios);

- Existence of linear extrapolation.

Advantages & limitations of the Chain Ladder reserving method

Benefits

- + Simplicity, transparency, explainability and ease of implementation, making it the method most widely used by actuaries for calculating reserves.

- + Based solely on historical data, with no need for complex models

- + Applicable to various insurance lines with few adjustments

- + Can be used for all types of data, including claims, premiums, number of claims, recoveries, etc.

- + Highly reliable method for triangles with low year-on-year volatility (consistency)

Limits

- – The method is highly dependent on the quality and completeness of historical data: missing or inaccurate data will lead to an unreliable reserve calculation.

- – Sensitivity to extreme values, which can impact forecast reliability

- – Since the main assumption of the Chain Ladder method is that past claims experience is a good representation of future claims experience, the method is less suitable in the event of major external changes (although inflation can be taken into account).

Addactis experts’ opinion

Comparison with other reserving methods

Insurance companies can use various methods to calculate their reserves: the Chain Ladder method we’ve just described, the Bornhuetter-Ferguson or Loss Ratio methods; or the Average Cost & Average Cost per Claim methods.

It is possible to combine several methods to provide greater flexibility in the calculation of their reserves and refine their estimates, particularly for more volatile lines of business. The important thing is to be able to justify your choices to your auditors and regulators.

This is the case with the Chain Ladder method, which insurance companies sometimes wish to combine with another method to improve forecast accuracy, or to compensate for one of the method’s limitations, depending on the context.

Addactis experts’ opinion

- If the insurer has sufficient historical claims data (covering the standard run-off of the underlying risk), and the Chain Ladder assumptions are validated, then he can clearly use this method to perform his reserve calculation.

- In the situation where Chain Ladder can be used, if the insurer has doubts about the amounts of claims paid over the most recent periods (amounts on which the most ratios will be applied), then he can use the Bornhuetter-Ferguson method over these periods and obtain his reserves by combining these two methods.

- But if the reserving is carried out on a newly launched product, and therefore for which the insurer has no history, then he will not be able to use the Chain Ladder method, and will therefore turn to a method that is not data-dependent, but based on exogenous assumptions, such as the Loss Ratio method.

Further insights about reserving:

How to choose the right reserving method?

Are you an insurer constantly questioning whether your current reserving methods are the best? In this article, we’ll explore the four essential reserving methods every actuary should master: Chain Ladder, Bornhuetter-Ferguson, Average Cost, and De Vylder.

Benchmark: practices and challenges in non-life reserving methods

Here is an overview of the main findings of our Benchmark “Practices and challenges of non-life reserving methods“, carried out by our teams with insurers and actuaries.

Streamline your Reserving process with Reserving by Addactis®

We are pleased to introduce Reserving by Addactis®, our new cloud-based SaaS solution designed to simplify and optimize your reserving processes.