Two additional reserving methods for handling special cases

In accordance with national and international regulations, insurance companies must, at a minimum for their financial statements, estimate their technical provisions.

This actuarial valuation must be justified in terms of the data used, the parameters employed, and the valuation methods applied.

In the case of non-life reserving, the methods most frequently used in the market are the Chain Ladder method, the Bornhuetter-Ferguson method, and the Loss Ratio method. However, there are situations where these methods are not optimal for calculating the insurer’s reserves.

This is why two other methods are widely used in the market because they are more relevant in certain situations, which will be detailed below: the Average Cost method and the Average Cost per Claim method.

Average cost & Average cost per claim methods: Presentation & Applications

The Average cost and Average cost per claim methods are similar, as the latter is an extension of the former.

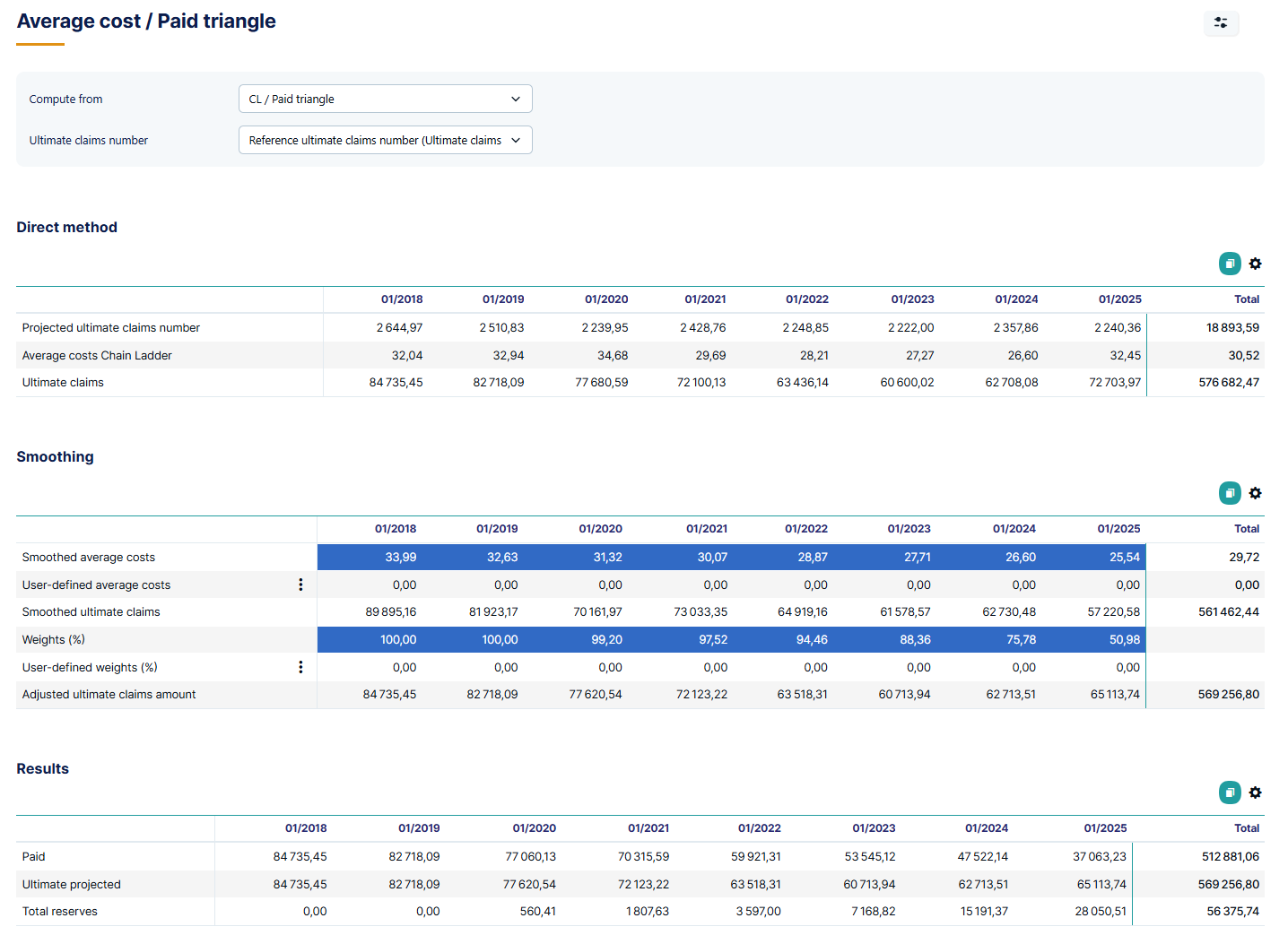

- The Average cost method consists of multiplying the ultimate number of expected claims by the average cost of claims.

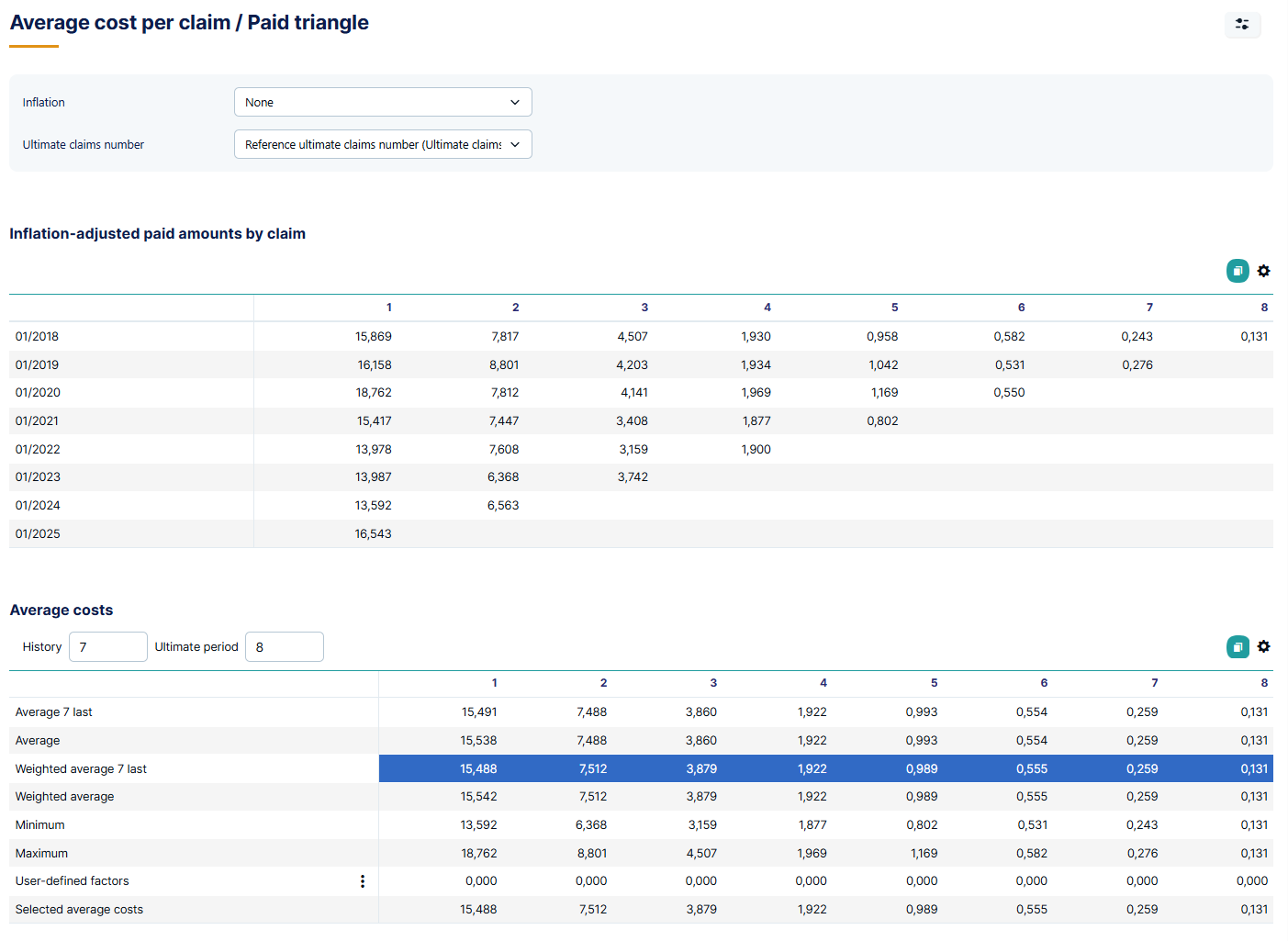

- The Average cost per claim method follows the same logic but with an additional analysis of average costs: these are projected on the basis of historical average costs observed in the available claims data (similar to the ratios used in the Chain Ladder method).

The ultimate number of claims is the same in both methods; the difference lies in the estimation of average costs per period.

- For the Average cost method, the ultimate average costs per period are applied as is.

- For the Average cost per claim method, the average costs per original period used are estimated from a triangle of amounts and a triangle of number of claims via an analysis of their evolution over the development periods. The calculation of average costs is therefore a step in the method..

These methods are particularly relevant in the case of lines of business with short development periods and to receive a high frequency of claims. In these situations, the development rates of claims are unstable, which makes the use of the Chain Ladder and Bornhuetter-Ferguson methods questionable.

They are also relevant in cases where the volume of data is moderate, as here too the rates of development will be unstable (cases where the volume of data is insufficient for a Chain Ladder method but does not justify the use of a Loss Ratio method).

Addactis experts’ opinion

Two reserving methods to be favored in some situations

A typical case where these methods are relevant is glass breakage risk: the number of claims is very high, and the development pattern is very short.

Also, in a context of unstable inflation, it is easier to adjust average costs at the end of each period than to review development pattern.

These methods are therefore easier to apply in these situations.

Average cost & Average cost per claim methods: Advantages & Limitations

Advantages

- + Both methods are simple and quick to implement.

- + Both methods are easy to explain to both actuarial and non-actuarial stakeholders.

- + They are a very good option when claims development does not allow for the proper application of the Chain Ladder and Bornhuetter-Ferguson methods, but there is still enough data to avoid applying the Loss Ratio method.

Limitations

- – The main limitation of the average cost method is the counterpart to one of its advantages: it does not take into account the development of claims and therefore considers the average cost to be stable.

- – The average cost per claim method compensates the previous limitation as the average costs are calculated, but the ultimate claim used remains fixed.

- – In both cases, the method is very sensitive to errors in estimating the ultimate volume of claims.

- – These methods are not well suited to complex portfolios.

The Average cost and Average cost per claim reserving methods therefore offer several undeniable advantages, which make them particularly suitable in certain actuarial contexts, notably due to their ease of use and flexibility.

However, it is crucial to bear in mind that these methods also have substantial limitations, particularly in terms of accuracy and adaptability to complex portfolios.

Addactis experts’ opinion

These reserving methods can be a relevant option in some specific situations, especially when data is limited or when traditional methods (Chain Ladder, Bornhuetter-Ferguson, Loss Ratio, etc.) are hard to use.

However, they should be used carefully and with appropriate oversight, especially for complex portfolios or uncertain environments.

It is therefore strongly recommended to include critical analysis and sensitivity testing to anticipate risks related to estimation errors or unexpected changes in the portfolio, and thus ensure the robustness and reliability of the projections produced.

To go further:

How to choose the right reserving method?

How do you know that the insurance reserving method you are currently using is the “best”? How do you decide when to change methods?

Reserving : Bornhuetter–Ferguson & Loss Ratio methods

It is essential for an insurer to have an accurate and correct estimate of its reserves, which can be achieved using the Bornhuetter-Ferguson and Loss Ratio methods.

Benchmark: practices and challenges in non-life reserving methods

How are leading insurers transforming their non-life reserving practices in today’s volatile environment?

Compare your reserving methods and processes with market leaders and discover actionable insights.