Streamline and transform your entire reserving process

From reserving studies and claims analysis to cash-flow projections and regulatory compliance, discover the areas and needs covered by our Reserving software, a SaaS solution designed to simplify, secure and optimize your reserving processes!

Addressing your needs in the reserving process

With Reserving, we offer insurers a powerful and user-friendly solution, designed for excellence in actuarial reserving. By integrating best practices and methodologies from leading insurance markets, the business application streamlines and transforms the entire reserving process – from raw data to final reports. It supports not only actuarial precision but also enhances process automation, data quality, and monitoring. This ensures technical rigor, operational efficiency, and effective team training, all within a single platform.

FEATURES

Shaping the future of Reserving

Accessible anytime, anywhere, our SaaS solution provides step-by-step guidance to ensure accuracy and efficiency.

User-friendly and intuitive interface

Easily navigate, create triangles, modify values as needed and analyze your reserving data, in a few clicks.

Use Proven Methods

Rely on the market’s favorite methods: Chain-Ladder, Bornhuetter-Ferguson, Average Cost, Average Cost per Claims, Loss Ratio and Mack Bootstrap methods. Obtain and compare your results.

Step-by-step guidance

Easy-to-navigate menus and helpful templates will guide you step by step through your reserving process.

Customizable parameters

Streamline and customize your reserving process with various parameters and options: paid or incurred triangles, underwriting or accounting origin years, and apply inflation vectors as needed.

Excel-like logic replication

Easily replicate your existing Excel-based methods within the app. Maintain control and familiarity while accelerating your process with automation.

Scenario testing

Test assumptions and simulate different reserving scenarios to assess the impact of changes and support strategic decision-making.

Traceability & auditability

Every change is traceable: add comments, track modifications, and export audit trails to ensure full transparency and compliance. Your calculations and results are ready for view at all times, both internally and externally.

Volatility analysis

Understand reserve uncertainty with advanced parameters for analyzing volatility and variability across methods and assumptions.

THEY TRUST US

More than 2,200 users trust our solution

OVERVIEW

How it simplifies your Reserving Process

Watch our video to explore the user-friendly interface in action and see how easily you can calculate reserves in just a few clicks.

THE ADDACTIS PLATFORM

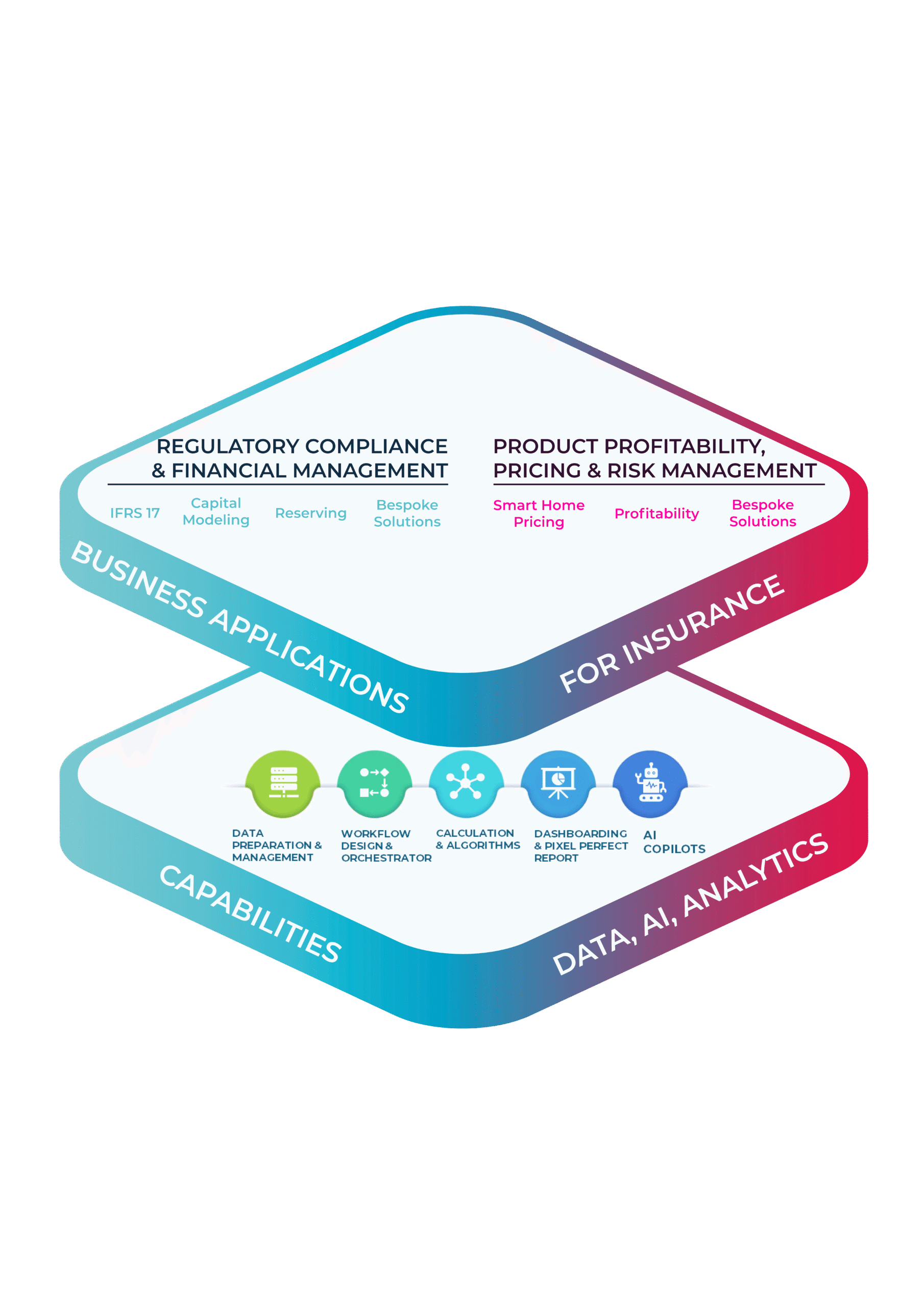

Our solution is part of the next-generation Actuarial Risk Management Platform

Experience unparalleled reliability, efficiency, and innovation with a system crafted to meet the dynamic needs of the insurance industry. Elevate your business operations today and stay ahead of the competition with our unique, cutting-edge solution.

Our platform is the only one on the market that seamlessly addresses both regulatory and profitability scopes, ensuring your success in a highly competitive landscape.

A unique and unified actuarial platform, designed to ensure compliance and profitability, through a range of powerful solutions.

RESOURCES

Explore our content related to Reserving

Reserving : Bornhuetter–Ferguson & Loss Ratio methods

Reserving: Chain Ladder, the essential method

In non-life insurance, reserving is a regulatory component of risk management. Its purpose is to estimate the technical provisions needed to cover the insurer’s future commitments.

Benchmark: practices and challenges in non-life reserving methods

What are the reserving best practices to tackle challenges in non-life insurance?

The Addactis Observatory has conducted a nationwide survey of non-life insurers in the French market, in order to update its previous studies and highlight market trends in a rapidly changing environment.

FAQ

More about Reserving

How does our Reserving software ensure data quality, automation and auditability?

Our reserving solution offers fully automated and integrated processes with complete audit trails, enabling the identification of changes and ensuring the adequacy, completeness, and accuracy of data through automated data controls. Our solution helps you minimize manual tasks and reduce risk.

How does our Reserving software ensure compliance with Solvency II and IFRS 17?

The software includes specific modules that comply with Solvency II and IFRS 17 standards, facilitating accurate calculation of Best Estimates and cash-flow projections using both the Building Block Approach and the Premium Allocation Approach.

How our Reserving solution simplifies your process?

- Set geometry: Set the origin type, start and end dates, and periodicity, with the option to add diagonals for efficient updates.

- Fill triangles: Define the type and input values effortlessly.

- Adjust parameters: Customize inflation or exposure vectors as needed.

- Calculate methods: Use industry-standard methods like Chain-Ladder, Bornhuetter-Ferguson, Loss Ratio, and more for advanced configurations.

- Select reserves: Choose the final reserves for the study from among the calculated methods.

- Assess results: View the final results of the studies.

- Get quantiles with Mack Boostrap and normal or log-normal distribution

More than a tool, the Reserving software is your complete solution, guiding you with intuitive menus and helpful templates.

How does the Reserving solution integrate with our existing systems?

Our solution is designed to seamlessly connect with your information system. It streamlines data flow and triangle exchange with a robust audit trail, ensuring traceability and integration with your existing architecture.

Which reserving methods are supported?

Our solution includes a full range of actuarial methodologies such as Chain-Ladder, Bornhuetter-Ferguson, Average Cost, Average Cost per Claims, and Loss Ratio. You can calculate technical reserves, risk measures, Solvency II Best Estimates, and IFRS 17 risk adjustments—all in just a few clicks.

How to choose the right reserving method?

To choose the right reserving method, consider the following:

- Chain-Ladder: A method that projects future claims based on historical development patterns, assuming past trends represent the future trends. The mostly used method on the market.

- Bornhuetter-Ferguson: A hybrid method that combines prior expectations (often from loss ratios) with observed data, giving more weight to expected loss early in development and actual data later.

- Loss Ratio: A method that estimates reserves by applying an expected loss ratio to earned premiums, often used when there is limited claims development data.

- Average Cost: A method that projects future claims by multiplying the number of claims by an expected average cost per claim.

- Average Cost per Claim: A refinement of the average cost method, separately projecting the number of claims (frequency) and the average cost per claim (severity), then combining them.

Select a method based on the nature of your data and the specific characteristics of your insurance line. Our Reserving software includes the mostly used reserving methods on the market.

Solutions

Premium contents

Careers

Governance

ESG

Personal data protection Charter

Partner Program

Contacts

addactis® is a registered trademark, property of ADDACTIS Group SA, used by our companies to market their service offering.

©2026 - ADDACTIS Group - all rights reserved