Upon its entry into force, the Solvency II Directive included two review clauses:

- In 2018, for the sole delegated regulation (level 2).

- In 2020, for the directive (level 1) and the delegated regulation (level 2).

The Addactis experts offer you an analysis of the Pillar 1 major changes, definitely adopted at Level 1 and still draft at Level 2.

In this article, you will find these 6 key points:

Legislative process for the 2020 Solvency II Review

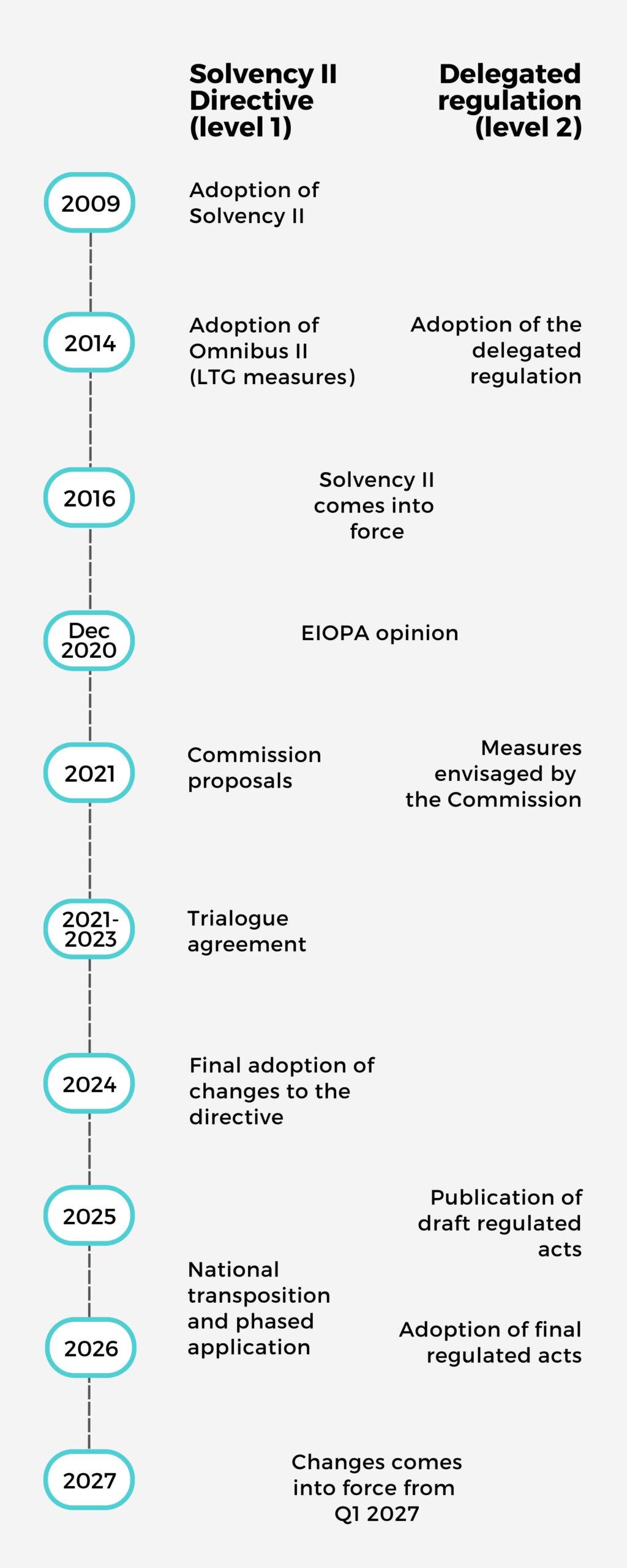

In December 2023, the trilogue negotiations between the European Parliament, Commission and Council reached an agreement on the Solvency II Directive.

The reviewed directive was then formally adopted by MEPs in April 2024 and published in the Official Journal of the European Union (OJEU) in January 2025.

The amended directive entered into force 20 days after its publication and the measures will be applicable two years later, i.e. from 1 January 2027 for the first quarter of 2027 closings.

The European Commission has yet to adopt the amendments to the delegated acts. To this end, it published a draft text for consultation in July 2025.

Pillar 1 in the 2020 Solvency II Review: 6 Key Issues

Extrapolation of the Risk-Free Rate Curve

Objective: To take into account liquid market data beyond the first extrapolation point in order to benefit from an enhanced best estimate.

Themes:

- First Smoothing Point (FSP)

Replaces the current Last Liquid Point (LLP). It corresponds to the first maturity beyond which interest rates will start converging towards the UFR.

- Volatility Adjustment (VA)

Added on top of the extrapolated part of the curve (beyond the FSP).

- Convergence Parameter

The UFR weight should correspond to 77,5% of the extrapolated rates 40 years after the FSP as a minimum. According to the draft regulated acts, a new convergence formula for risk free rates towards the UFR with a convergence factor ”a” set at 11% for the Euro.

Volatility Adjustment

Objective: Redefine the VA to better mitigate the impact of observed spread movements on insurance liabilities.

Themes:

- Reference Portfolio Composition

Only composed of European debt instruments.

- Application Ratio

Increases from 65% to 85%.

- Sensitivity Ratio for assets and liabilities

Additional ratio specific to every undertaking to allow for differences in sensitivities between assets and liabilities, applied to the VA in addition to the application ratio.

- Macro-Economic VA

Will replace the actual national component with a correction factor linked to exposure specific to each country.

Risk Margin

Objective: To take into account the reduction of the correlation between risks throughout time and reduce sensitivity of the Risk Margin to interest rates variations.

Themes:

- Cost of Capital

New CoC fixed at 4,75% at level 1. The European Commission could review it at level 2 while staying in a 4% to 5% corridor.

- Introduction of a time-dependent parameter

This exponentially decreasing parameter λt aims at introducing a risk dependency evolution over time. Its value will drive the decreasing speed and will be confirmed at Level 2. The draft regulated acts propose a level of 0,96 for λ with a 50% minimum for λt

Standard Formula: Market SCR and correlations

Objective: to reduce the correlation between a reduction in interest rates and a change in credit spreads.

Themes: this correlation factor would go down from 50% et 25% in the draft regulated acts.

Standard Formula: Rate SCR

Objective: To better take into consideration the recent interest rate environment which could lead to an understatement of the SCR. Still at draft stage in the regulated acts.

Themes:

- Increased Capital Requirements relative to the interest rate shocks

Greater spread of both upward and downward shocks with the introduction of a shock on negative rates.

- Risk Correlation

Reduction in correlation between spread risk and interest rate down SCR from 50% to 25%.

- Transitional Phase

None.

Standard Formula: Equity SCR and symmetric adjustment

Objective: Provide room for manœuvre to undertakings so that they can contribute to the financing of real economy.

Themes:

- Criteria for the eligibility to Long-Term Equity Investments (LTEI)

Revised criteria to facilitate access to the derogatory prudential regime and expand the list of eligible assets. Reduction of minimum holding from 10 to 5 years.

- Equity risk sub-module based on duration

Removal of the sub-module.

- Equity Dampener

Increase the upper and lower bounds of the dampener from +/- 10% to +/- 13%, enhancing the counter-cyclical effect of the measure.

Solvency II review: anticipating the changes ahead

The ongoing Solvency II review is expected to result in significant changes for both L&H and P&C stakeholders (risk margin, interest rate SCR, LTEI, and equity dampener), and other focused on long-term guarantees (interest rate curve extrapolation and volatility adjustment).

Addactis experts are available to assist in understanding the technical issues, the different positions of co-legislators, and the potential implementation timeline.

History of the progress of the Solvency II review

Summer 2023

In June 2022, the ECON committee of the European Parliament began discussions on the revision of Solvency II. The entire financial community anticipated a Parliament vote before the end of 2022 and a trialogue (negotiations between the European Parliament, the Council, and the European Commission) to be concluded in the first half of 2023. There were talks about its publication in the Official Journal of the European Union (OJEU) in July 2023.

Finally, after debates that lasted for over a year, the ECON commission has just voted on its text regarding the Solvency II revision this Tuesday, July 18th, 2023.

During an intervention with the GDV, the German Association of Insurers, Markus Ferber, a German Member of the European Parliament and rapporteur for the proposed amendments to the Solvency II Directive, mentioned this vote. Indeed, over a year after his initial proposal, he expressed confidence in the approval of the compromise he was about to submit for the deputies’ vote. In this compromise, Mr. Ferber announced that he had retained the three main axes of his initial proposal:

- The release of capital for insurers.

- The right regulatory level with key technical elements that would move from level 2 to level 1 (yield curve, volatility adjustment, or LTEI).

- Proportionality and raising the exemption thresholds.

The IPE magazine, which attended his intervention with the GDV, had dedicated an article to the subject.

In the projects they published in 2021 and 2022, the European Commission and Council also pursued the objectives of capital release and improvement in the application of the proportionality principle. However, the choice to move level 2 measures to level 1, which would disrupt the regulatory architecture of Solvency II, was not made by the Commission and Council. This element could lead to intense negotiations during the trialogue.

It should be noted that for now, no publication of the compromise has been made, and therefore, we do not know the exact content of this compromise: what has been removed and/or amended compared to the version proposed for discussion in the meeting.

However, now that Mr. Ferber’s compromise has been approved by the ECON Commission on July 18th, 2023, the trialogue is expected to begin in September, 2023 [1]. Considering the transposition deadlines in different national laws, the insurance industry now expects the revision to come into effect in 2026.

[1] Subject to confirmation of this vote during the plenary session of the European Parliament scheduled for the week of September 11th 2023.

Summer 2022

What Are the Latest Publications on the Subject?

- September 22, 2021: The European Commission published a draft of amendments to the directive

- June 6, 2022: The European Parliament published a draft of amendments to the directive

- June 17, 2022: The European Council published a draft of amendments to the directive

These three texts will represent the positions of the European Commission, the European Parliament, and the European Council as they begin the trialogue negotiation, though the Parliament’s document is still far from being its final position.

The Trialogue Negotiation: A Long and Complex Process

Access our presentation to understand why the trialogue negotiation is a lengthy and complex process. Discover examples of positions from the European Commission, the European Council, and the Parliament regarding the risk margin and the extrapolation of the yield curve.

Facilitate your Solvency II compliance with Addactis

Addactis Capital modeling software supports Solvency II compliance in line with the Solvency II directive and other regulatory standards, covering key actuarial requirements. Our Solvency II software helps insurers streamline governance and risk management while remaining agile and compliant in complex regulatory environments.

This article is written by:

Antoine CHANH

Senior Manager – Modeling & Risk P&C

François BAYÉ

Head of Actuarial Consulting

Thibaut GILLIARD

Deputy Head of Modeling & Risk Health

Related articles on Solvency II

Solvency II: the Ultimate Forward Rate by EIOPA

Solvency II – Ultimate Forward Rate (UFR): Read our experts’ comments and analyses on EIOPA’s latest publication about UFR.

Read More >

Risk-free rate curves and EIOPA data

Each month, Addactis lists and summarizes the economic parameters used to produce the solvency ratio and the economic balance sheet: risk-free rate curves, volatility correction, symmetrical equity adjustment, etc. Read our article now.

Read More >

ORSA & Solvency II: turning compliance into strategic advantage

ORSA under Solvency II goes beyond compliance. It serves as a key driver of better governance, strategic planning and risk management.

Read More >