Ensuring data accuracy and integration from multiple sources is a significant challenge for actuaries and financial teams. These challenges must be addressed to achieve transparency in financial results.

This article discusses the key data challenges under IFRS 17 and offers solutions for successful implementation and data quality.

IFRS 17 Overview

The implementation of IFRS 17

The implementation of IFRS 17 presents a significant challenge for actuaries, financial teams and management, requiring correct measurement and transparency of financial results.

Keys elements such as Revenue and Liability recognition, Evaluation of obligations, CSM, Contract grouping introduce a new level of complexity.

However, this shift also enhances transparency and comparability in financial reporting, with a focus on cash flows and more detailed financial disclosures.

IFRS 4 vs IFRS 17, what are the main differences?

Unlike IFRS 4, which allowed greater flexibility in reporting, IFRS 17 establishes a more structured approach to evaluating insurance contracts:

The role of data in IFRS 17

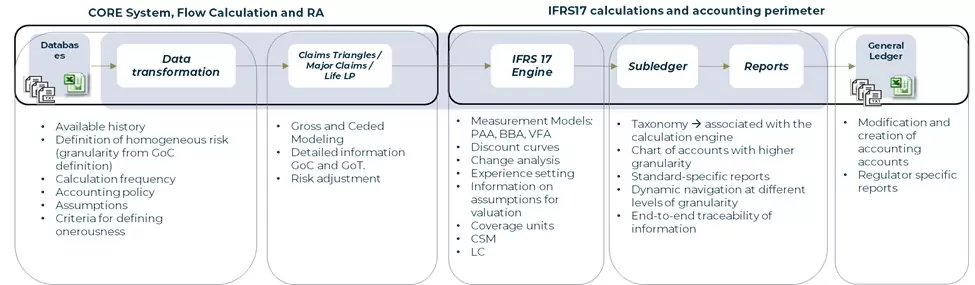

It requires complex data processing and transformation of projections; It generates complexity due to the lack of a clear definition of how certain calculations should be performed (non-prescriptive = methodological decisions) and the lack of the necessary granularity in the data.

It implies a strong integration between systems and areas of the company, as well as a significant impact on run times and storage capacity.

Type of data required

Data Management

1. Storage

2. Treatment

3. Analysis

Data-related challenges

Data complexity: Diversity and volume of data to be managed

- Required level of granularity (policy level) with a requirement for traceability from start (source) to end (reporting).

- Different formats, Empty data, Data in the user’s machines and/or different systems per area.

- Understanding of data and new criteria, Reviews are required from start to finish of the process, there is no single responsible party.

- Change of methodologies (current vs IFRS17) and this does not make the data comparable.

- Different currencies (functional vs. reporting). Structure of the one being taken to OCI or P&L.

Systems integration

Regulatory compliance and data security

Here are the essential challenges for IFRS 17 Compliance and Security Integration:

|

IFRS 17 Compliance

|

Data Security

|

Solutions and best practices for Data Management

Technologie and tools

Use of software and data management tools

- Best practices: Data structured in the same way to make report generation easier. E.g. Same date format

- Repository: Avoid having the data on the computer, but on an internal corporate network. Organization of data repository E.g. Established formatting rules

- Data management tool: The most common tool is Microsoft Excel, but unless you have programmed macros, it is very difficult to check automatically.

- Software usage: It would be ideal to have a software, understanding the capacity of the company. Keys: data management support, Information management, Organization and Traceability.

Data governance

Implementation of policies and procedures for data management

Connection between equipment actuarial team and accounting team:

“How do I continue?“, “How do I switch from one equipment to another?“. It is important to have a defined system where all the information is unified, first actuarial, then accounting.

Data control policies should be in place, such as validation policies for moving forward. “Who goes first, who goes second?” IFRS 17 brings them together.

Data Processing:

“What procedures do I have defined?“, “Who performs reviews?“, “Who gives the go for the next step?”.

Establish policies prior to analysis.

Training and awareness

Why is it so important to train your teams in data management?

- Teams must know the why and why not of the importance of data quality.

- Awareness of the effects of the process, from the beginning to the end.

- What does your participation involve?

- Importance of verification.

- If there are defined structures, human error is reduced, it helps to ensure good data quality.

Why improving data management for IFR 17 Compliance?

- Improving data management is essential for maintaining accuracy, as manual processes increase the risk of errors and uncertainty.

- A structured and well-defined system and/or process allows the traceability of information from start to finish, with the required level of granularity to produce reliable and consistent results.

- Having a robust information management process is important to avoid errors in the data that could lead to incorrect financial figures being reported to the market.

- Training teams on the Standard is not only essential to validate the reliability of the results, but also to:

- Understand the company’s financial position

- Identify key impact variables (e.g., estimation assumptions, variation in discount curves, cash flow, etc.).

- Data quality and accuracy are critical to accurately reflect the insurers’ financial situation.

- Implementing effective data management practices enables insurers to:

- Comply with IFRS 17

- Ensuring accurate calculations

- Make better-informed decisions and

- Optimize their operations

Ensuring data quality not only meets the requirements of IFRS 17, but also strengthens strategic decision-making within the organization.

Related content on IFRS 17

Mutualidad renews its trust in Addactis through its IFRS 17 project

Mutualidad renews its trust in Addactis through its IFRS 17 project. Read more about this insurance company’s experience.

Data, systems integration, processes, reporting…The strategic role of Finance in IFRS 17

In the rapidly evolving insurance industry, finance and accounting teams are essential drivers of operational improvement and regulatory compliance. Discover our article about the Strategic Role of Finance in IFRS 17.

Key Considerations for a Smooth IFRS 17 Implementation

Discover the critical steps insurers must take for a successful IFRS 17 implementation, including gap analysis, data readiness, and system upgrades.

< onerror="this.style.display='none'" />

< onerror="this.style.display='none'" />