What if growth and profitability depended on your pricing and underwriting policies and strategy?

The African non-life insurance market is a case in point.

Everyone agrees that Africa is virtually absent from the world map of non-life insurance and that the African market is the world’s largest reserve of growth potential. This is a first paradox for this continent, which saw the birth of one of the oldest forms of financial solidarity (and insurance) among the Phoenicians.

All indicators point in the same direction: from insurance penetration rates on the continent (on average half that of the rest of the world) to economic development generating a rapid growth in insurance needs. Given the crucial function of insurance as an enabler of economic development, every new asset or person covered for any additional risk is good news for the continent. This trend is so strong that the COVID crisis will not fundamentally change it and will, at worst, only delay it by a few months or years.

Increasing technical pressure on insurers in the African market

Every insurer on the African continent must be part of this growth, especially as they are under pressure from all sides.

The main pressures on the non-life insurer come mainly from the various technological, regulatory, environmental and behavioural changes that our profession has to face in a particularly «brutal» momentum.

Towards a complete transformation of Pricing

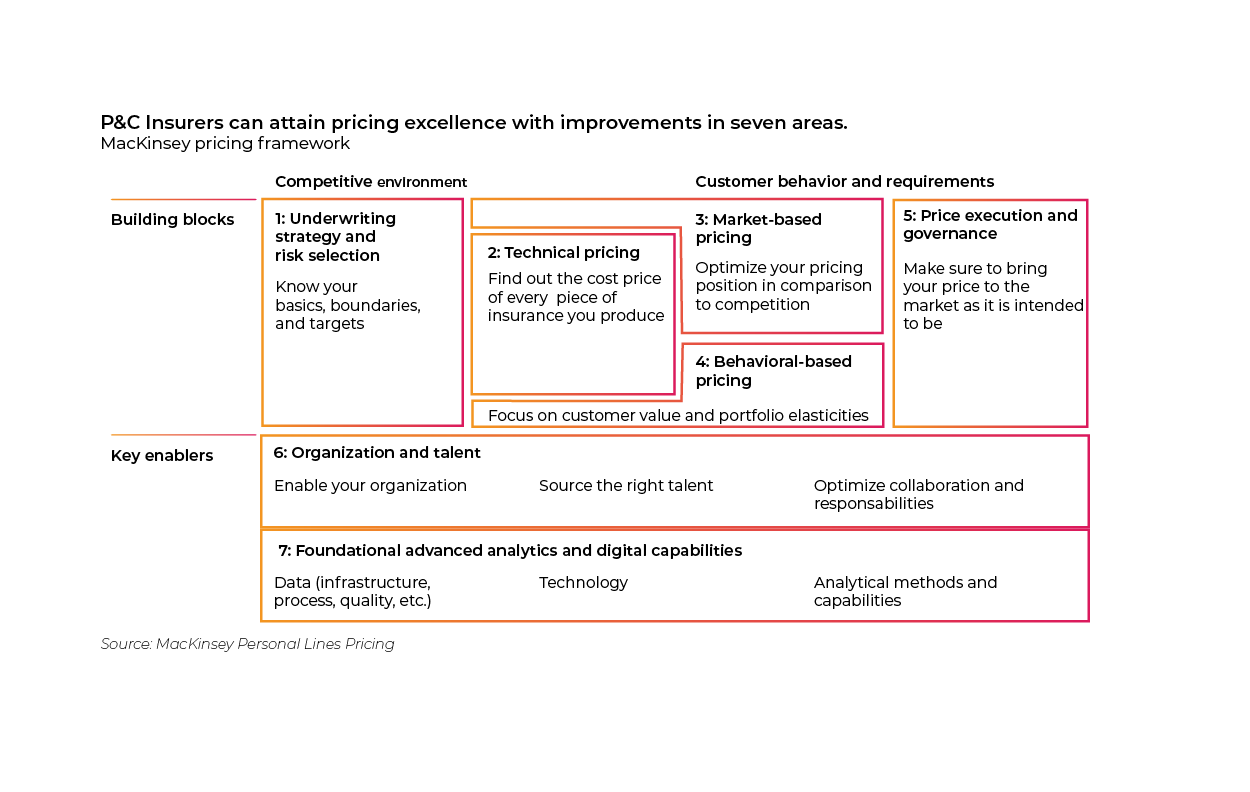

In a recent article entitled «The post-Covid-19 pricing imperative for P&C insurers», McKinsey & Company illustrated in the following table (the «McKinsey Pricing Framework») the implementation of a dedicated process for non-life insurers to achieve pricing excellence:

These recommendations, which are truly universal, also apply to the African continent, provided that they take into account the specificities of local markets.

5 ways to improve your pricing strategy in Africa

Underwriting strategy and risk slection

As the excellent article by R.Durand and A.Chneiweiss in the Revue d’Economie Financière “The Insurer, the

7 myths and 3 lessons” reminds us, this step is fundamental, but it is only a necessary prerequisite for the actual pricing. The uninsured risks are so important in Africa that specific and highly segmented products can be very successful.

The target segments can be high-growth markets, such as cities, where most of the potential for rapid growth is concentrated, or rural markets (e.g. one Acre Fund distributing microinsurance products for farmers in Uganda, Kenya and Tanzania).

The pressure or requirements of the regulator on certain coverages, particularly compulsory coverages, also sometimes forces the insurer to think about underwriting, under the constraint of its risk appetite or its capacity to generate growth.

Technical pricing and the indispensable GLM (Generalized Linear Model)

This technique consists of optimising its tariff policy to make it a real competitive advantage. The less a company controls its risks by being able to calculate its technical rates finely, the more it tends to rely on the market.

This blind follower strategy can be even more dangerous in the medium or long term on growing and highly competitive markets such as the African markets. Moreover, it requires a very high level of reactivity, or even automation of processes through the implementation of «robo-pricing» for example (prohibited in certain countries where insurance rates must be approved in advance by the regulators).

Market-based pricing

For many years, the GLM has been the essential technical basis for all mass risk pricing in non-life insurance.

It is a proven statistical method used by the majority of the world’s leading insurers. It allows for the determination of risk variables and therefore the review of rates based on past loss experience (replacing the rules of three or other simplistic statistics that ultimately increase rates indiscriminately based on experience), but also by combining external or market data.

The limit to the development of GLM in Africa is explained both by the lack of qualified personnel: actuaries, actuarial technicians or statisticians and less pressure so far from competitors, regulators and consumers. At the same time, the lack of reliable and usable data can be a hindrance for some players. Of course, technical pricing (pure premium) must then be completed by an analysis of production and distribution costs to arrive at the commercial premium.

Pricing based on customer behaviour

For example, it can be used to simulate the effects of a premium increase or decrease on risk results according

to policyholder behaviour: cancellation or new subscription, improvement or deterioration of risk and results.

In the case of insurance markets in Africa, the customer behaviour approach is relevant for tariff revisions,

but especially for integration with marketing strategy (new products/new markets/different distribution

channels).

The pricing process

Pricing is more than just the calculation of a pure premium, but includes, after this calculation, the

implementation of the tariffs in the underwriting process, as well as the monitoring of these tariffs and the

quick identification of possible deviations.

The nature of pricing changes completely, transforming a discontinuous cycle – usually one or two often

critical annual periods – into a continuous cycle, which is essential for the management of the non-life

insurance company in the current environment.

The two major enablers, key elements for Africa

Organisation and talents

Many insurance companies in Africa hide behind a lack of talent to delay any further reorganisation or

evolution of their underwriting process. However, it is important to remember that this talent shortage is

global and certainly not unique to Africa.

On the contrary, statistical, data science and mathematical skills are plentiful in Africa and they can find in

pricing a field to develop a specific know-how adapted to the particularities of African markets, innovate,

launch new products, work on new risks, on determined segments with a perfectly adjusted pricing grid

that they can follow and make evolve in full knowledge.

Fundamental analytical and digital tools

The industry will inevitably have to invest in analytical and modelling tools to meet evolving needs,

encouraging the gradual integration of new skills, new models or new data into the process. The tools

will have to be operational quickly, to reduce the «go-to-market» and the time needed to implement the

global strategy.

Conclusion

The top 4 steps of the pricing strategy to prepare you for sustainable

growth:

- Make an uncompromising diagnosis of the existing situation (avoiding the 6 pricing myths);

- Take a look at the winning practices not only in your markets but also elsewhere (best practices);

- Determine the level at which you want to start the evolutionary process (GLM? Customer Behaviour? Optimisation? Data Sciences?);

- Choose the people and tools to invest in.