Facilitate your Solvency II compliance and manage risks efficiently

How does our solution support your challenges for regulatory compliance and business efficiency? Meet quantitative & qualitative requirements, regulatory reporting needs of Solvency II compliance or other standards such as RBC, SST… Ensure an agile and smooth compliance process with our Capital Modeling solution!

Enhance Solvency II compliance with our Capital Modeling solution

Towards a more reliable and secure relationship with your supervisor thanks to our dedicated, fully auditable software, designed for all insurance prudential standards and enhanced by decades of practice around regulatory aspects.

From constraint to opportunity, determine and optimize your solvency ratios and indicators with the utmost precision, for all sectors of activity, taking full advantage of our Addactis’s cutting-edge expertise in actuarial modeling integrated into this solution.

FEATURES

Master regulatory challenges with our Solvency II solution

The software is dedicated to Solvency II production. Thanks to a user interface dedicated to production for all calculation steps adapted to regulatory closings with a real-time workflow, you can master regulatory challenges.

Regulatory Compliance

Stay updated with ever-changing regulations and meet the highest standards effortlessly.

Business steering

Make informed decisions considering business impacts, profitability, and risks.

Resource efficiency

Save time during Solvency II assessments, valuations, and risk management.

Technical excellence

Access key figures, validations and decisions seamlessly, digitalizing your working methods.

Advanced actuarial library

Access our integrated, optimized, maintained, and tested actuarial model libraries for comprehensive resources.

THEY TRUST US

More than 50 companies are using our Capital Modeling solution for their Solvency II compliance

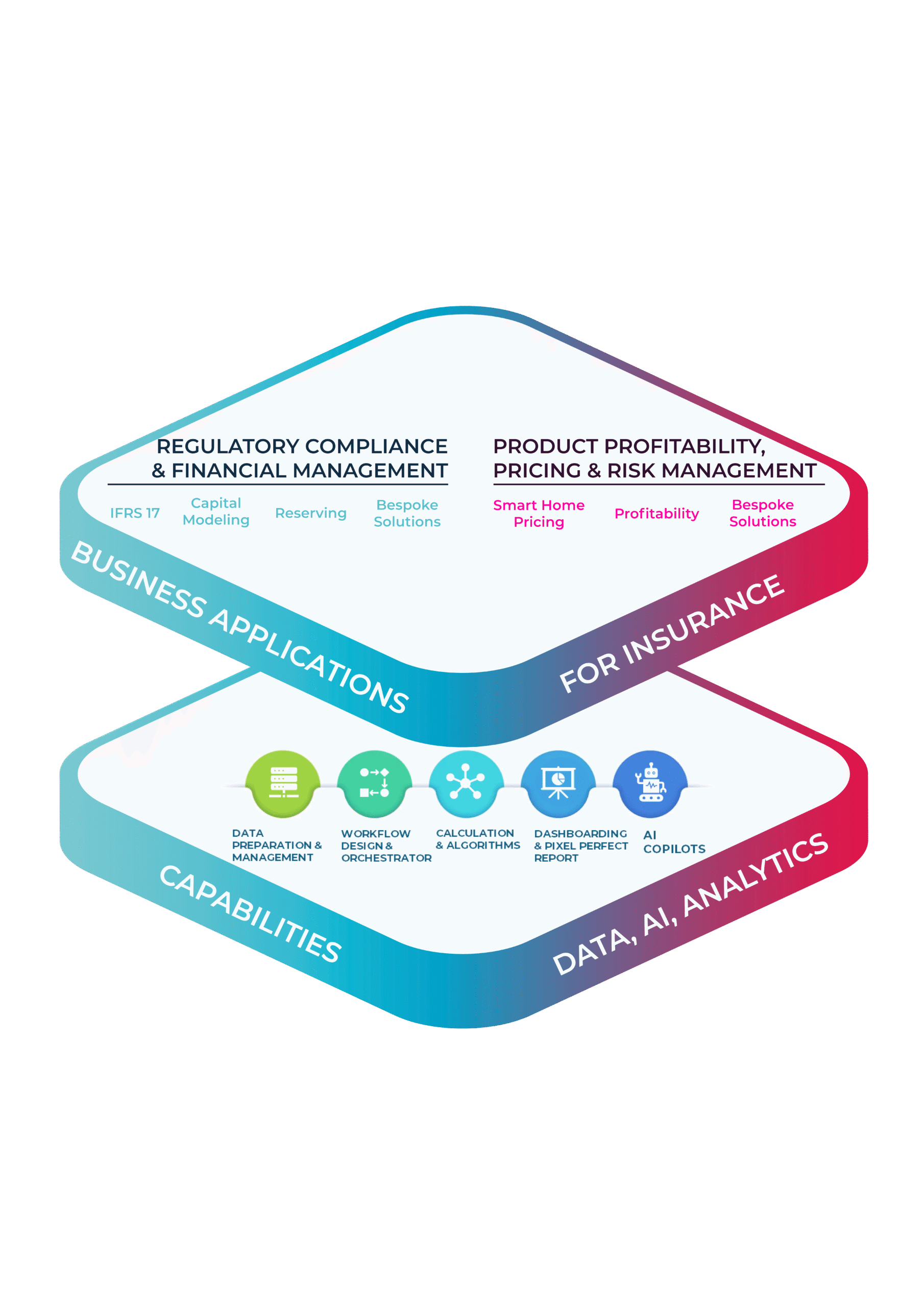

THE ADDACTIS PLATFORM

Our solution is part of the next-generation Actuarial Risk Management Platform

Our comprehensive SaaS platform is designed to transform and accelerate the development and customization of insurance solutions. Whether you specialize in Life insurance or non-life insurance, our platform promises to deliver substantial business value and operational efficiency.

Experience unparalleled reliability, efficiency, and innovation with a system crafted to meet the dynamic needs of the insurance industry. Elevate your business operations today and stay ahead of the competition with our unique, cutting-edge solution.

Our platform is the only one on the market that seamlessly addresses both regulatory and profitability scopes, ensuring your success in a highly competitive landscape.

A unique and unified actuarial platform, designed to ensure compliance and profitability, through a range of powerful solutions.

Thanks to the Addactis Platform, the Capital Modeling solution is connected to other software.

RESOURCES

Explore our content related to Solvency II

Risk-free rate curves and EIOPA data

Each month, Addactis lists and summarizes the economic parameters used to produce the solvency ratio and the economic balance sheet: risk-free rate curves, volatility correction, symmetrical equity adjustment, etc. Read our article now.

2020 review of the Solvency II Directive | Draft amendments to delegated acts Main impacts on pillar 1

The trilogue has concluded, and the Solvency II review is moving forward. But what are the real changes for Pillar 1? Our new expert paper analyses the key amendments already adopted and those that are under development.

Solvency II: the Ultimate Forward Rate for 2026 by EIOPA

Solvency II – Ultimate Forward Rate (UFR) for 2026: Read our experts’ comments and analyses on EIOPA’s latest publication about UFR.

FAQ

More about Solvency II and Capital Modeling

What are the objectives of Solvency II?

The objectives of Solvency II are:

- Enhancing the protection of policyholders and beneficiaries: Ensuring that insurance companies are financially capable of meeting their obligations to policyholders.

- Deepening the integration of the EU insurance market: Facilitating a more uniform and efficient European insurance market.

- Increasing the international competitiveness of EU insurers: Helping EU-based insurers to be competitive on a global scale through a robust regulatory framework.

- Promoting better risk management: Encouraging insurers to improve their risk management practices and capabilities.

- Ensuring better regulatory supervision: Providing a framework that promotes a consistent approach to supervision across EU member states.

- Increasing transparency and accountability: Improving the transparency of insurers’ financial positions and operations both to regulators and the public.

What are the 3 pillars of Solvency II?

The three pillars of Solvency II are designed to enhance the regulation of the insurance sector in Europe:

- Pillar I: Quantitative requirements – This pillar requires insurers to maintain sufficient capital to cover the risks they undertake. It includes the evaluation of the balance sheet, the Solvency Capital Requirement (SCR), which is the capital needed to absorb significant losses, and the Minimum Capital Requirement (MCR), which is the minimum safety threshold below which the insurer’s solvency is considered inadequate.

- Pillar II: Governance and supervision – It mandates that insurance companies have robust governance systems and conduct their own regular Risk and Solvency Assessment (ORSA). This pillar focuses on the quality of risk management, strategy, and the regulatory supervision process.

- Pillar III: Transparency and reporting requirements – This pillar requires insurers to publish detailed information about their risk profile, governance system, and solvency. This includes the regular publication of Solvency and Financial Condition Reports (SFCR) to inform the public and supervisory authorities.

Capital Modeling helps you reach Solvency II compliance across all three pillars: capital, governance and reporting.

What is the step-by-step Solvency II approach?

There are 5 steps:

- Step 1: Data Collection and Management

Efficiently gather all necessary data inputs from various sources, formats and data connections, ensuring perimeter completeness. Manage data flows seamlessly between different transformation steps, maintaining traceability and integrity. Embeds data quality checks on data input. Access dashboards for data quality restitution, data overview and analysis. Add input step for each team. - Step 2: Calculation and Analysis

Use our advanced actuarial libraries, completed with various use cases, to perform all required calculations with precision. Our integrated tools support complex actuarial models, providing robust and reliable results. Design features allow to customize the solution to fit your products mechanisms. All along the closing process, dashboards allow to present standard indicators to understand, communicate and monitor key indicators related to valuation, projection solvency. - Step 3: Reporting and Compliance

Generate comprehensive reports that meet all regulatory requirements. Ensure compliance with Solvency II standards, providing transparent and detailed documentation for auditors and stakeholders. - Step 4: Review and Decision-Making

Analyse generated reports to make informed decisions. Our solution offers real-time insights into business impacts, profitability, and risks, aiding in strategic planning and business steering. Accurately model the different stress test scenarios set by the regulator or by the company’s executive board. Compare results for each step. At the end, compare some scenarios. - Step 5: Continuous Improvement & operational risk adjustment

Implement feedback loops to continuously improve the actuarial processes and models. Stay updated with changing regulations and adapt swiftly to ensure ongoing compliance and efficiency. Get the granularity in risk measurement you need for Solvency and for coming IFRS17 frameworks.

What are the advantages of the Addactis Capital Modeling solution?

Our Capital Modeling solution helps you stay compliant with evolving regulations while ensuring technical excellence through seamless access to key figures, validations, and digitalized workflows. By accessing actuarial model libraries and comprehensive resources, you optimize profitability and manage risks more effectively. Capital Modeling also contributes to your Solvency II assessments, valuations and risk management to make you save more time.

Solutions

Premium contents

Careers

Governance

ESG

Personal data protection Charter

Partner Program

Contacts

addactis® is a registered trademark, property of ADDACTIS Group SA, used by our companies to market their service offering.

©2026 - ADDACTIS Group - all rights reserved