Addactis organises “Pricing Games”, a competition between students, academics, or practitioners, based on solving an actuarial problem.

In other words, the Pricing Game is a competition-based activity that engages participants in solving a real-life actuarial problem. Participants have to build an end-to-end pricing project to find the best solution to the problem.

It is centered on the use of statistical modeling techniques to estimate pure premiums under different contexts. Our Addactis team provides support along the Pricing Game, giving the necessary tools to carry on the analysis.

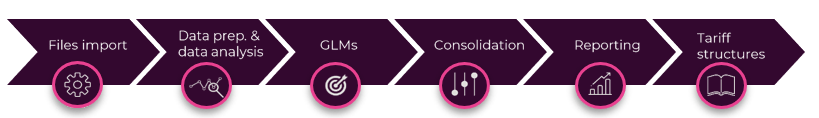

The Pricing Game is designed according to the traditional pricing workflow (Figure 1):

Figure 1 : Pricing Workflow

Why organize a Pricing Game for your teams?

The Pricing Game highlights how the participating teams can each make different pricing decisions under the same market circumstances.

Each team in the competition can approach the problem in a different way, creating different pricing segments and targeting different levels of profitability and retention. The analyses they provide can contribute fully to the understanding of various aspects of pricing in the market being studied for the Pricing Game.

What often emerges from the results is that multivariate models are fundamental to calculating more accurate risk-adjusted premiums, but they are not sufficient to succeed in a competitive market. Pricing practitioners need to guide decision-makers to achieve the insurer’s specific profitability and sales objectives.

The combination of actuarial methodologies, new technologies and effective decision-making processes will be essential to thrive in the new market conditions.

Why choose Addactis for your next Pricing Game?

Our Pricing Games aim to help Pricing Practitioners to get a general vision of an end-to-end pricing workflow, understand the role of the pricing actuary in the insurance business and apply actuarial theory to quantify financial risks in an insurance problem.

Our teams, committed to supporting and training the next generations of actuaries, have also developed a Pricing Game format adapted to students.

Indeed, Addactis has twice organised and animated a Pricing Game for actuarial students of the University of Malaga, and once for the University of Beijing, China, and each time it has been a very rich experience, both for the students and for the Addactis experts.

The main objectives of such an event if for students to:

- Have a global idea of the non-life pricing process.

- Understand the role of the actuary as a risk analyst and its impact on decision making.

- Be able to link modelling theory with the construction of technical premiums.

What are the topics we usually cover in our Pricing Game?

Here are the main topics addressed during the event:

Concept of risk differentiation and adverse selection

Inflation, trend and exposure analysis

Concepts of actuarial indicators, frequency, severity, and pure premium

Statistical modelling with multivariate techniques (GLMs)

Premium Models consolidation

Impact analysis for out-of-sample projections

The participants work in teams. Each team’s final performances are evaluated on profitability, retention and risk model accuracy (RMSE), in that order of importance.

Each team has to fulfill a minimum customer retention ratio of 80% to qualify for the ranking.

How do we design a Pricing Game with a Data generator?

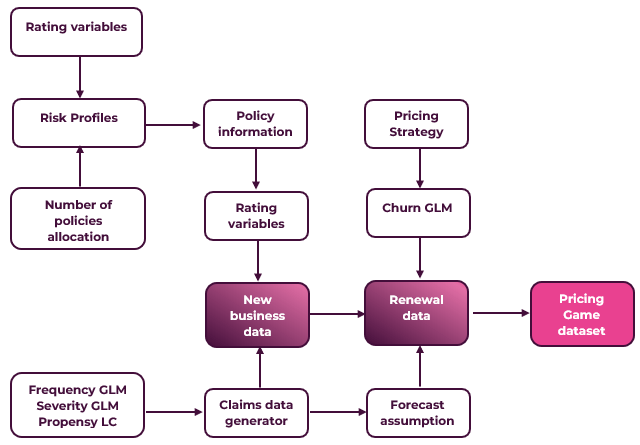

Designing the Pricing Game involves creating several data generating processes that, together, can mimic real information (Figure 2).

Holding the data generator allows us to derive the implicit risk that each participant will assume with the chosen rating strategy.

By simulating the out-of sample dataset several times, one can re-evaluate each team’s performance and quantify the profit variation resulting from its pricing decisions.

Figure 2: Creating multivariate synthetic data for the Pricing Game

Discover our Pricing Game Pre-Program

Most of the time, the competition is divided into two main parts spread over two days: first, the computation of a technical price using Generalized Linear Models (GLMs); second, a commercial price definition implementing a simulation-based methodology.

How we design our 2-days format Pricing Agenda?

Day 1: Kick-off, Introduction and Launch of the Pricing Game.

Day 2: GLM modeling, Premium consolidation & Loss projection, Model selection and Delivery of results.

Would you like to know more about addactis® Pricing Games?

Feel free to contact us, we’ll be happy to hear from you!

Check our related content

Pricing: a priority for non-life insurers in Africa

What if your company’s growth and sustainable long-term profitability depended on your pricing and underwriting policies?

The African non-life insurance market is a case in point.

Why is non-life Insurance not taking off in Africa?

Why is insurance in Africa not fulfilling the economic, financial & societal roles that it is being asked to play?

What is the reason for this failure?

The Top 6 Myths of Non-Life Pricing Insurance

The experience we have gained over the last 25 years during our numerous missions around the world has enabled us to understand and respond to the many beliefs surrounding pricing. We have selected 6 Myths around pricing, which seem strangely persistent and widespread within all types of non-life insurance companies.