Addactis experts present a synthesis of the 2024 stress test exercise launched by EIOPA on April 2, based on a scenario of re-intensified or prolonged geopolitical tensions.

SCOPE

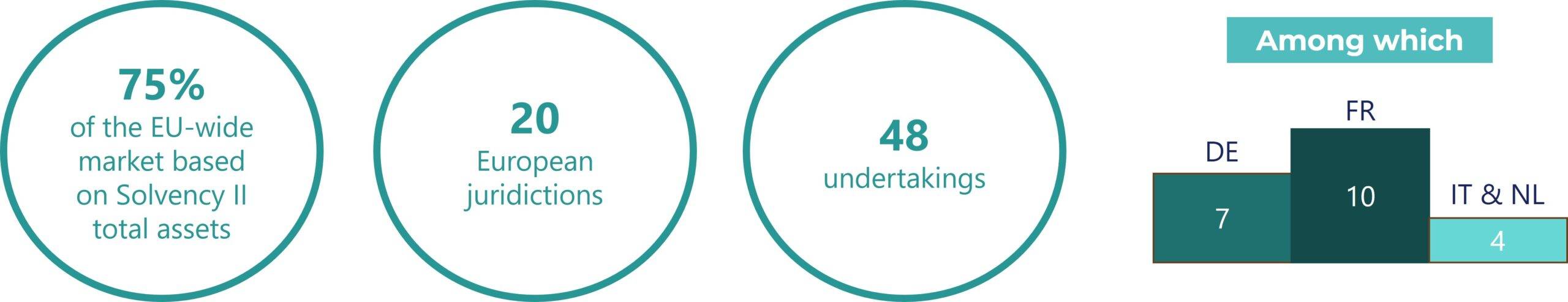

A European exercise:

The target sample includes 48 companies registered in 20 European jurisdictions. The selected sample covers 75% of the EU market, based on total assets declared at the end of 2022 under Solvency II.

AGENDA

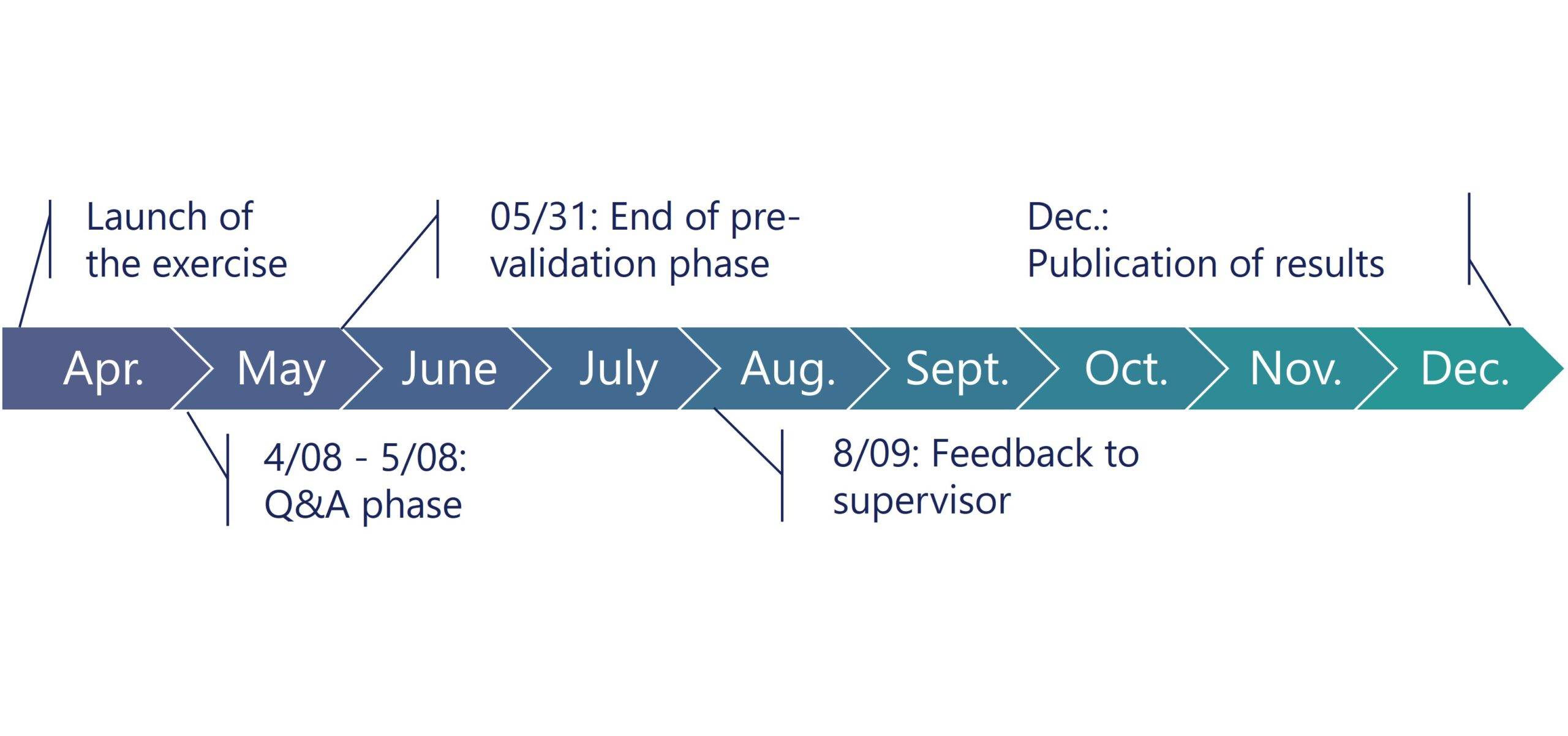

EIOPA launched its stress-testing exercise on April 2nd. The results are due from insurers on August 9, and EIOPA will publish its final report in December 2024.

Below are the major milestones of this exercise:

INDICATORS TO BE CALCULATED

The 2024 stress test assesses the resilience of the European insurance industry from two angles:

SCENARIO

A single scenario of intensifying geopolitical tensions, with disruption of supply chains, economic slowdown, rising inflation and interest rates, and numerous cascading effects.

METHODOLOGY

FRAMEWORK

Application of the Solvency II framework

REPORTING

Group-level reporting

REFERENCE DATE

December 31, 2023 (the baseline must correspond to the annual submission of the QRT 2023)

APPROACH : Full Balance Sheet

Insurers have to recalculate their entire balance sheet against the various shocks. The full balance sheet approach covers two calculations:

- Fixed Balance Sheet : only management actions already embedded in the models can be considered; post-shock management actions are prohibited.

- Constrained Balance Sheet : post-shock management actions are authorized under certain conditions.*

APPLICATION OF SHOCKS : one-off

Shocks are one-off shocks to be applied on the reference date in the following order:

- First, financial shocks (step 1), taking into account the transparency approach for mutual funds.

- Then insurance-specific shocks (step 2).

Insurance shocks are to be applied simultaneously.

SIMPLIFICATIONS

Simplifications to the calculation of shocks or their scope of application may be applied after discussion with the national supervisor during the exercise’s pre-validation phase.

*Post-shock management actions are allowed under the following conditions:

-

- external recapitalization operations in the form of equity or debt insurance are prohibited and, as regards liquidity, only repo contracts negotiated prior to the launch of exercise are authorized ;

- intra-group transactions must be discussed during the pre-validation phase;

- regarding the liquidity assessment, no action of the public powers can be considered (e.g. temporary suspension of redemptions);

- more generally, any management action requiring approval outside the insurer’s governing bodies is excluded.

SHOCKS

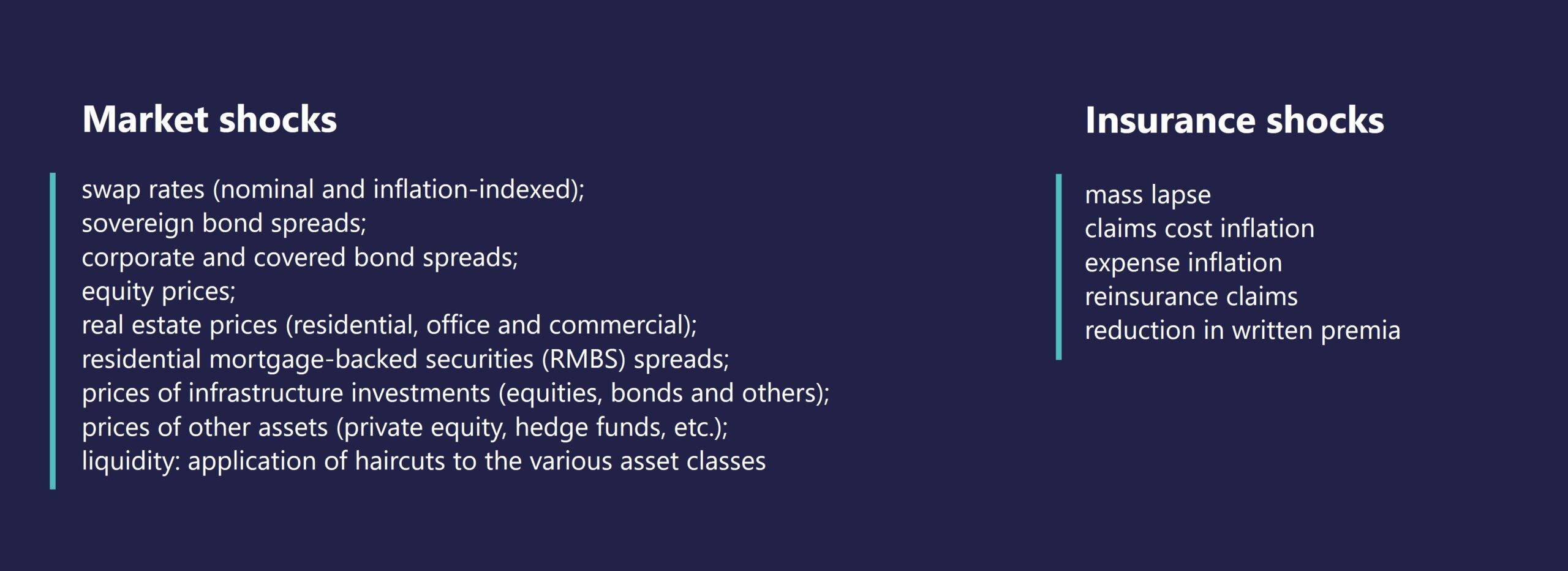

Here is an exhaustive list of market and insurance shocks:

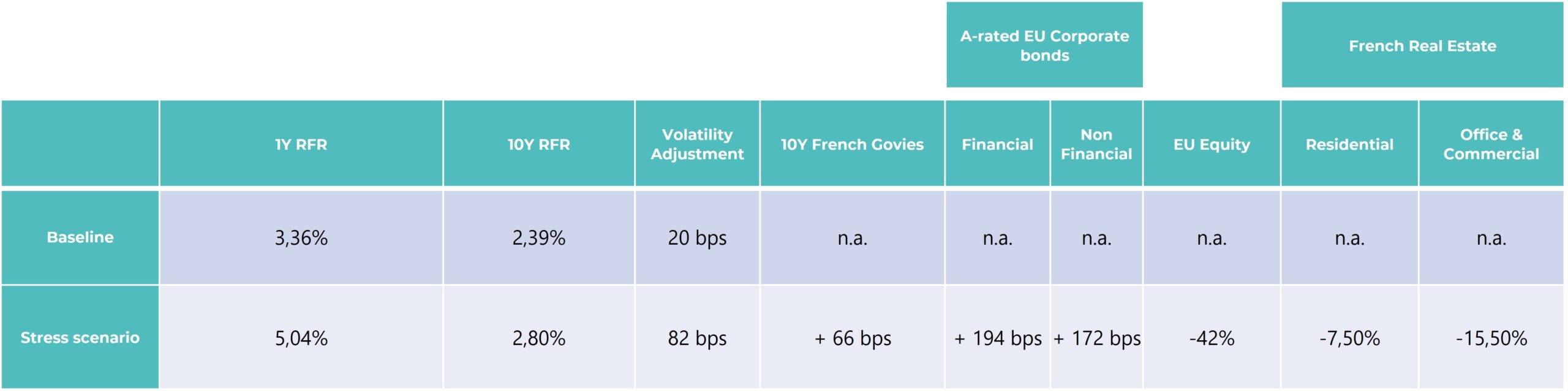

Here is an overview of the shock level of some of the key indicators shown above (non-exhaustive list):

MARKET SHOCKS

INSURANCE SHOCKS

REPORTING

Insurers must report according the 3 cases: baseline, fixed balance sheet and constrained balance sheet.

Capital indicators

Liquidity indicators

Ad hoc templates on flows and stocks, plus a questionnaire.

This article was written by our experts:

Adrien BAYEUX

Senior Manager

Modeling & Risk Health

François BAYE

Director

Deputy Head of Actuarial Consulting

Simon THIBAULT

Director

Modeling & Risk Life

Tuyen LE

Manager

Modeling & Risk P&C

In-Depth Insights on Solvency II

Explore our complimentary blog articles for related content on Solvency II:

Solvency II: EIOPA publishes the Ultimate Forward Rate (UFR) for 2025

Ultimate Forward Rate 2025: Following EIOPA’s publication, read our experts’ insights on the calculation methodology, the value of the UFR 2025 for the euro currency, the evolution of the UFR and the LLP and much more.

Risk-free rate curves and EIOPA data

Each month, Addactis lists and summarizes the economic parameters used to produce the solvency ratio and the economic balance sheet: risk-free rate curves, volatility correction, symmetrical equity adjustment, etc.

2020 review of the solvency II directive

After situating this step in the overall timetable for the 2020 review, Addactis experts offer you a summary of the major changes at level 1 (directive) related to Pillar 1, and the issues still to be addressed at level 2 (delegated acts).