Press Release

2022, June 22nd

With addactis® Celer(ity), insurance companies can optimise all risk management processes on a web-based platform

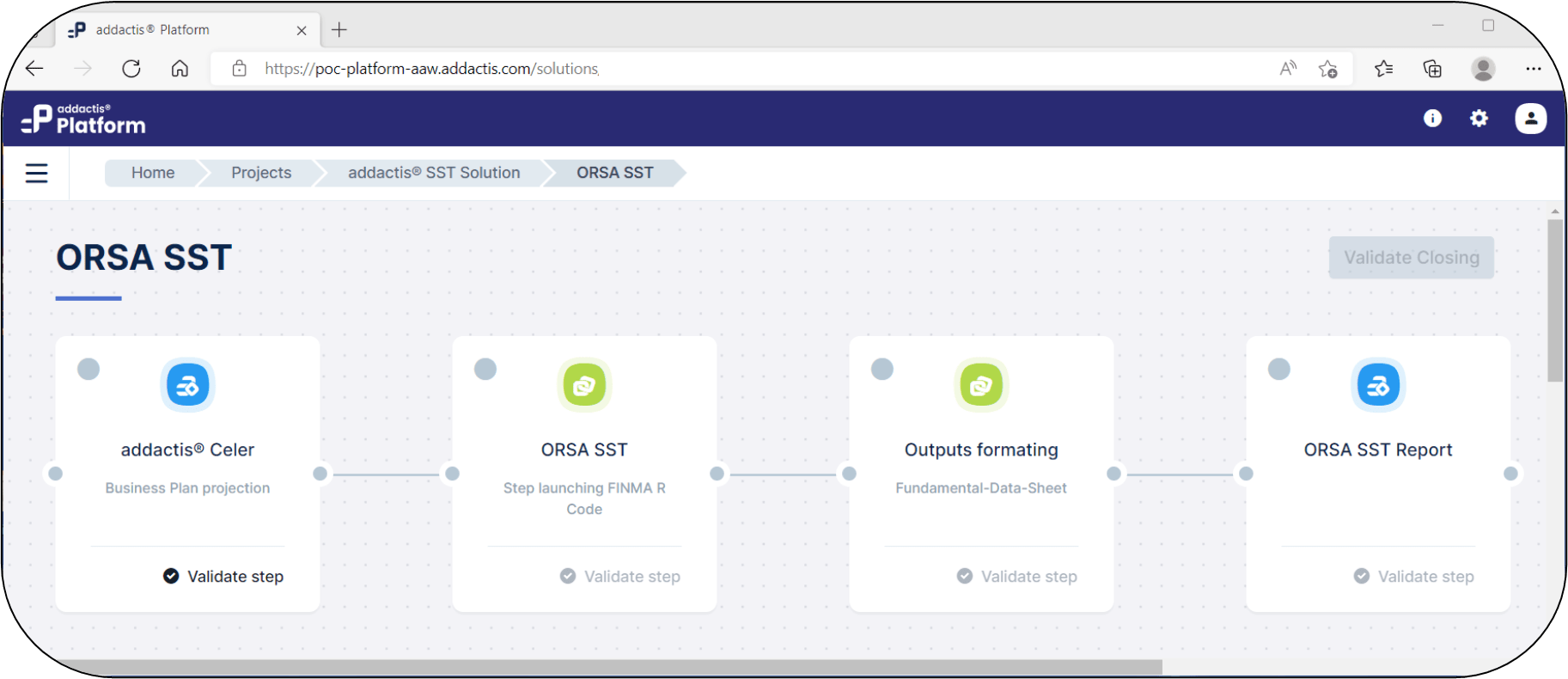

Fig. 1: Screenshot of the SST add-on – representation of the process

The market and credit risks are determined based on the standard SST template presented in addactis® Celer. In addition, the insurance-typical SST templates Nonlife, Life, Health, StandRe and Captive are integrated into the solution for estimation of the insurance risks.

Business Plan

Subsequently, both the balance sheet and profit and loss accounts as well as the portfolio holdings are updated over the entire planning period, and the respective SST templates are filled with new input parameters for each scenario and planning year.

ORSA STT Report

Optionally, the SST computations of FINMA can be partly or completely transferred into addactis® Celer and thereby also customised. In the process, addactis® Celer can be smoothly linked to existing systems, such as for managing the capital investments. In addition to transparent surveillance of the individual work steps, this solution also enables plausibility checks and monitoring of (interim) results and real-time analysis of risk values via dashboards. The management is thus able to immediately assess the effects of multi-year planning in the balance sheet and income statement, the economic risk situation and capital requirements.

This successful cooperation will continue to pay off for clients in future, since regulatory requirements are constantly examined by Azenes/Volada and implemented by Addactis in the system in good time.

Furthermore, customers can independently implement internal risk approaches, ALM and/or financial optimisation in addactis® Celer.

addactis®

addactis® is strongly committed alongside global insurers and reinsurers for 30 years. We transform actuarial complexity into opportunities for our clients. We work as architects to design solutions for product optimization and regulatory compliance. We draw on both our proven knowledge of the insurance industry, through our historical consulting business line in Europe, and our range of actuarial software to offer innovative technological solutions that meet the regulatory and profitability requirements of insurers around the world. The addactis® «analytics» solutions provide a reliable and sustainable response in terms of risk and solvency assessment, reserve calculation, data management, task automation, pricing, reporting, strategic management and insight into insurers’ decisions.

www.addactis.com

Azenes

Azenes AG is a company specialising in actuarial consulting. Together with our affiliate Volada AG, we ensure well thought-out handling of regulatory requirements. We support clients in all regulatory issues relating to SST and Solvency II, from risk modelling to model assessment and customisation.

www.azenes.ch