IFRS 17 Post-Implementation challenges

IFRS 17 was effective in January 2023 in the international insurers market. French insurers are facing today huge challenges as they are publishing new figures.They must provide technical interpretations and a comparative financial statement view with IFRS 4.

Recently, our team of experts conducted an insightful webinar titled, “How to Interpret and Master Your IFRS 17 Accounts?”

Featuring François BAYÉ, Ines BEN ABDELHAMID, Romain NOBIS, Yann DELVIGNE, and Yapei LI, the webinar delved into the intricacies of navigating the complexities posed by IFRS 17.

In this article, we will present the main key messages of the webinar, an overview of new financial indicators and a comparative interpretation of financial results.

Survey Results Highlights

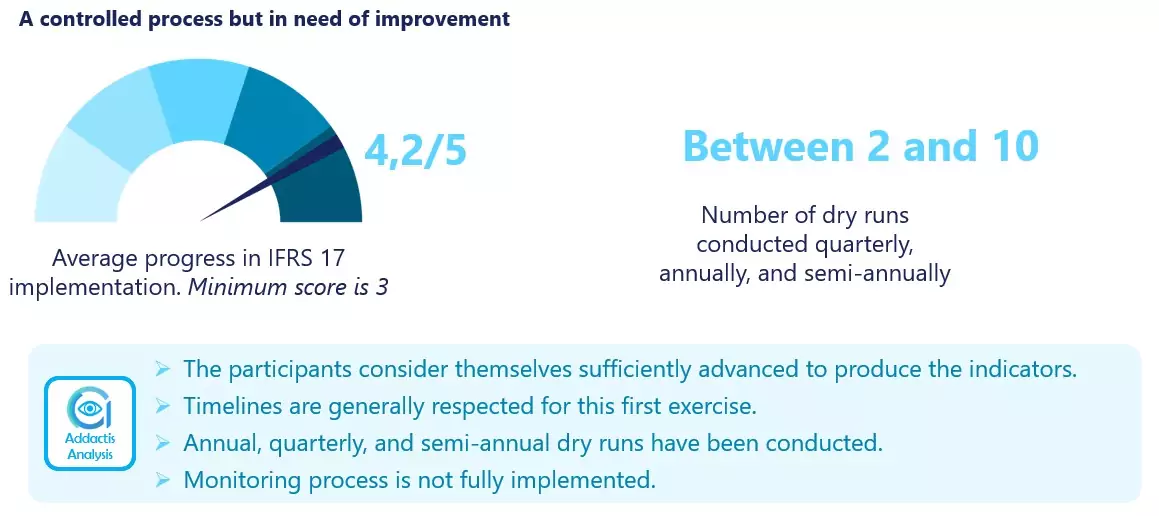

Addactis experts have conducted a survey to have a concrete post-implementation feedback from 13 insurers in France.

The results show us that the respondents consider the new calculation process is well implemented. Nevertheless, only 30% of them confirm that new process and results are fully managed and interpreted.

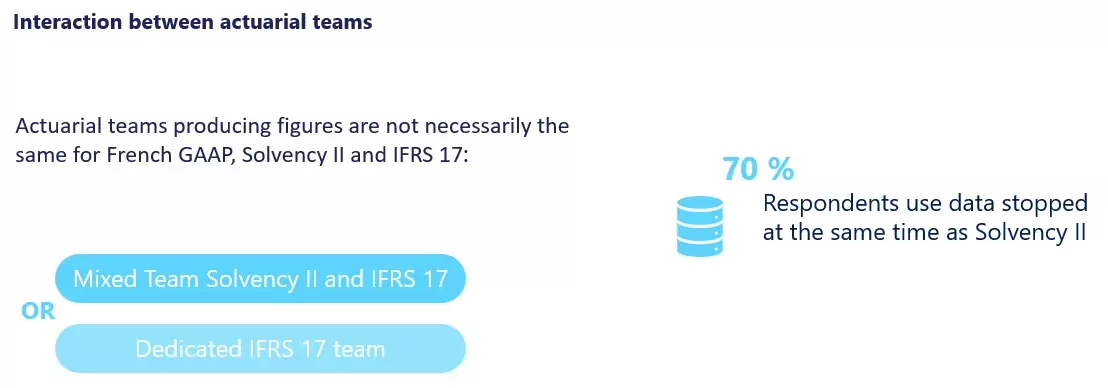

Optimizing time and resources seems to be a priority for insurers. In fact, 70% of the participants claim extracting data for Solvency II and IFRS 17 process at the same time. Concerning IFRS 17 methodologies, they observe homogonous choices, especially for yield curves and Risk adjustment calculation.

As a conclusion, IFRS 17 implementation project is well advanced in the French market today. The remaining challenges are interpreting and communicating new financial results to internal and external interlocutors.

Figure 1: Progress in IFRS 17 implementation

Figure 2: Production Process

IFRS 4 vs IFRS 17 – Comparative Exercice

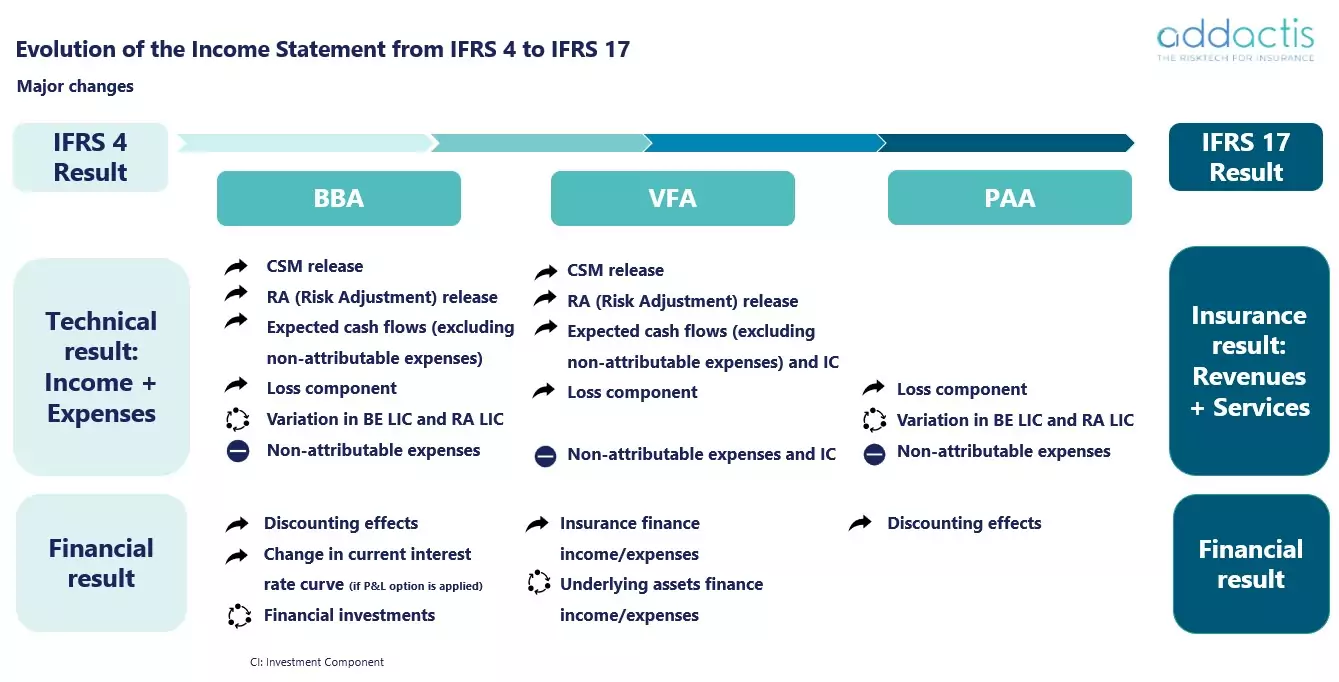

Addactis experts prepared a comparative exercise between IFRS 4 and IFRS 17 Profit and Loss accounts. By illustrating the three IFRS 17 models (VFA, BBA and PAA), they highlight the transformation of the P&L and the creation of new technical items such as CSM and Risk Adjustment release, expected outflows and Loss component.

A main additional difference between IFRS 4 and IFRS 17 is financial impacts due to an economic modeling of insurance liability under IFRS 17. The study shows that for BBA, actuarial modeling can have an impact on results creating a gap between IFRS 4 and IFRS 17. This gap can be adjusted by well defining actuarial assumptions, coverage units and risk adjustment calculation. Concerning VFA, the gap depends mainly on asset-liability mismatch, the classification of assets under IFRS 9 and the activation of OCI option. For PAA, observed gaps are mainly due to discounting and economic provision modeling under IFRS 17.

Figure 3: Evolution of the Income Statement from IFRS4 to IFRS 17

Unveiling Key Performance Indicators under IFRS 17

Discover the four major categories of indicators

Addactis experts present different new financial indicators that can be used today as KPI and KRI. They classify those indicators in four categories: Business, profitability, risk, equity.

1. Business Indicators

As premiums are no longer part of the P&L, they suggest using the Insurance Revenue, the CSM and the Insurance Results to build new business indicators such as Insurance Revenue growth, CSM growth distinguished between run-off and new business contracts… Those indicators depend on actuarial assumptions and IFRS 17 chosen methodologies.

2. Profitability indicators:

Regarding profitability, the Return of Equity can be redefined under IFRS 17 by an indicator including the CSM as an estimation of future profits.

3. Risk Indicators:

Risk measurement can be represented by a ratio estimating the Risk Adjustment as a percentage of PVFCF. Another risk indicator can be the estimation of experience variances by comparing incurred outflows to expected outflows.

4. Equity Indicators:

For equities, in the case of OCI option activation, the OCI variance reflects the impact of interest rates change on equity.

Finally, producing sensitivities can lead to an overview of those indicators in various scenarios and complement the financial analysis.

Experts insights- How to tackle KPIS challenges

CSM (Contractual Service Margin) becomes a key indicator.

Key Performance Indicators (KPIs and KRIs) must:

-

- Be tailored to the company’s business model.

- Cover the entire activity, ensuring there is no loss of information (e.g., non-attributable expenses) with the transition to IFRS 17 indicators.

- Be consistent with the management of other reporting standards, particularly Solvency II.

- Take into account operational levers and constraints in defining indicators.

It is crucial for each company to understand the management levers and their impacts on IFRS 17 balance sheets and income statements:

-

- Business levers (pricing, renewals, new products, target market, etc.)

- Methodological levers (calibration of the Risk Adjustment, choice of coverage units, actuarial assumptions, etc.)

This content is written by

Ines Ben AbdelHamid

Senior Consultant, IFRS 17 expert, Addactis

In-Depth Insights on IFRS 17

Explore our complimentary blog articles for related content on IFRS 17:

Challenges and best practices for a successful IFRS 17 implementation project

As insurers embark on the IFRS 17 journey, they encounter multiple challenges.

Whether you are an early or late adopter, read our IFRS 17 benchmark and unlock expert insights for a smooth implementation.

The treatment of reinsurance under IFRS 17

While most of the IFRS 17 mechanisms are now well understood, certain specific aspects continue to raise questions.

In this e-book, our experts outline four points of vigilance in the treatment of reinsurance under IFRS 17.

How to speed your IFRS 17 implementation journey

Addactis has led more than 50 IFRS 17 implementations around the world in recent years and has been able to acquire solid expertise.

In this article we will highlight what we have seen so far in our implementations.