Insights from GAIF 2024 Conference in Oman

From February 18-21, our dedicated team, represented by our esteemed colleagues Wenlian HAN and Javier Aparicio Hurlot, had the privilege of attending the 34th General Arab Insurance Federation GAIF Conference in Muscat, Oman.

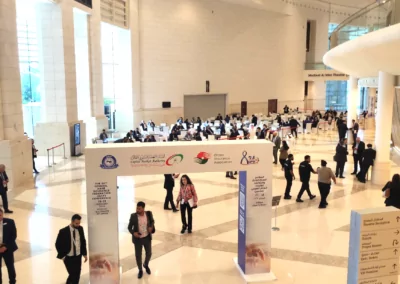

The event, hosting nearly 2000 participants from various Arab countries and beyond, served as a hub for insightful discussions on the evolution of the insurance landscape in this dynamic region.

Global Perspectives, Engaging Conversations, and Regional Visions

Event Key Highlights:

The GAIF34 Congress focused on addressing current global issues with a regional lens.

Discussions spanned a spectrum of topics, including innovations in insurtech, leveraging new technologies for enhancing the customer journey, strategies for sustainable growth, and a local/regional approach to natural catastrophes (NAT CAT).

Notably, significant attention was given to understanding the measures that regulatory bodies plan to adopt for the rational use of #AI.

Our team engaged with over 30 individuals representing more than 15 insurers. Conversations centered around the regulatory challenges impacting the entire region, with a keen focus on IFRS17 and solvency models.

These interactions provided valuable insights into the shared challenges faced by the industry and fostered connections for future collaborations.

The conference offered a unique opportunity to gain a deeper understanding of the local and regional dynamics affecting the insurance sector. Insights obtained will guide our future strategies as we navigate the regulatory landscape in the Arab world.

Looking Ahead:

This enriching experience has motivated us to conduct an exhaustive follow-up and deepen our relationships with key players in these markets over the coming months.

The characteristic hospitality of the Arab countries, including those in the Mediterranean, has further inspired us to strengthen our bonds and collaboration in the region.

Dive Deep into Our Blog:

Expert Insights and Analysis Await

Explore a wealth of knowledge on regulatory insights, insurance challenges, and beyond. Dive into our blog articles to stay informed and empowered.